Strong Fundamentals Keep Home Prices on Steady Rise

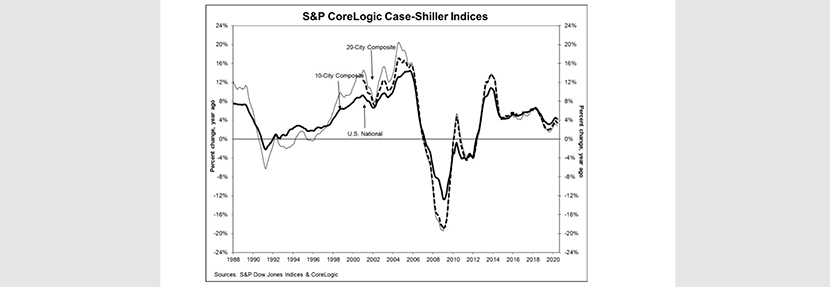

S&P Dow Jones Indices, New York, said S&P CoreLogic Case-Shiller Indices showed U.S. home prices rose by 4.3 percent annually in June, unchanged from May.

The 10-City Composite annual increase rose by 2.8%, down from 3.0% in May; the 20-City Composite posted a 3.5% year-over-year gain, down from 3.6% in May.

Phoenix led all measured cities with a 9.0% year-over-year price increase, followed by Seattle at a 6.5% increase and Tampa at 59%. Five of the 19 cities reported higher price increases in the year ending June versus the year ending May (data for the 20th city, Detroit, was not available for the report).

Month over month the National Index posted an 0.6% increase, while the 10-City and 20-City Composites posted increases of 0.1% and 0.2%, respectively, before seasonal adjustment in June. After seasonal adjustment, the National Index posted a month-over-month increase of 0.2%, while the 10-City Composite posted a decrease of 0.1% and the 20-City Composite was unchanged. Sixteen of the 19 cities (excluding Detroit) reported increases before seasonal adjustment, while 12 of the 19 cities reported increases after seasonal adjustment.

“Housing prices were stable in June,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy with S&P Dow Jones Indices. “More data will be required to understand whether the market resumes its previous path of accelerating prices, continues to decelerate or remains stable. That said, it’s important to bear in mind that deceleration is quite different from an environment in which prices actually fall.

“The strength of the Case-Shiller index reflects an ideal confluence of demographic and home buying fundamentals which keep driving home prices higher,” said Selma Hepp, deputy chief economist with CoreLogic said. “On one hand, there’s a very limited supply of homes. And on the other, a strong millennial demand driven by record-low mortgage rates and a need for more space. But, the housing market also highlights the tale of two income stratums. In one group, there are those who lost their income and are relying on forbearance programs. In the other group, which fared better, individuals are able to purchase a home.”