Record Low Rates Drive Mortgage Applications Increase in MBA Weekly Survey

Mortgage applications rose for the fourth time in five weeks as key interest rates once again fell to record lows, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending August 7.

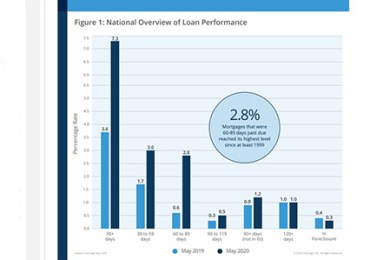

CoreLogic: ‘Clouds on The Horizon’ for Many U.S. Homeowners as Delinquency Rates Climb

Ahead of next week’s 2nd Quarter National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said early-stage and adverse mortgage delinquency rates increased for the second consecutive month, with all 50 states and more than 75% of U.S. metro areas seeing increases in overall delinquency rates.

CRE Professionals Envision COVID-19 Recovery by 2021

Initial concerns about the COVID-19 pandemic’s impact on multifamily real estate have not been realized, said Berkadia, New York.

MBA Asks CFPB to Extend GSE ‘Patch’ Sunset

The Mortgage Bankers Association, in a comment letter yesterday to the Consumer Financial Protection Bureau, asked the Bureau to extend the temporary GSE Qualified Mortgage loan definition, also known as the GSE “Patch,” for an additional six months following the effective date for the revised general QM parameters.