‘Strong and Resilient:’ CoreLogic Home Price Index at 2-Year High

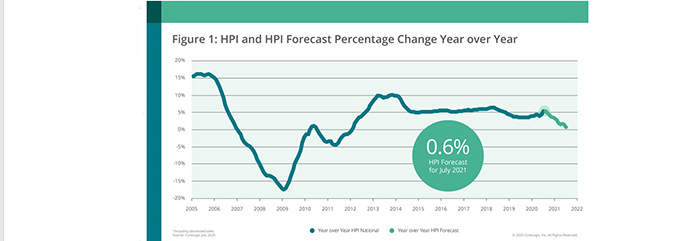

CoreLogic, Irvine, Calif., said its U.S. Home Price Index jumped to a 5.5% year-over-year increase in July, its highest level since 2018. Month over month, the Index rose by 1.2%.

Last month the Index posted 4.3% annual growth; in July, annual home price growth accelerated to its fastest rate in nearly two years. The report said the one-two punch of strong purchase demand — bolstered by falling mortgage rates, which dipped below 3% for the first time ever in July — and further constriction of for-sale inventory has driven upward pressure on home price appreciation.

Despite the rapid acceleration of national home price growth, local markets continue to fluctuate. In particular, the report said homebuying activity is becoming more pronounced in traditionally affordable suburban and rural areas that allow for more space as schools and work remain online. For example, home prices in Nassau and Suffolk counties on Long Island experienced an annual gain of 4.3% in July, as residents continue to migrate away from more densely populated areas like the New York-Jersey City-White Plains metro, which recorded only an 0.4% increase.

“Lower-priced homes are sought after and have had faster annual price growth than luxury homes,” said Frank Nothaft, chief economist with CoreLogic. “First-time buyers and investors are actively seeking lower-priced homes, and that segment of the housing market is in particularly short supply.”

The national HPI Forecast shows annual home price growth slowing through next July, reflecting the anticipated elevated unemployment rates during the next year. This could lead to an increase of distressed-sale inventory as continued financial pressures leave some homeowners unable to make mortgage payments, especially as forbearance periods come to a close.

Looking forward, the HPI Forecast also reveals the disparity of home prices across metros. In markets like Las Vegas, where the local tourism economy and job market continue to struggle from the effects of the pandemic, home prices are expected to decline 7.8% by July 2021. Meanwhile, in San Diego, home prices are forecasted to increase 5.8% over the next 12 months as low inventory continues to push prices up.

“On an aggregated level, the housing economy remains rock solid despite the shock and awe of the pandemic. A long period of record-low mortgage rates has opened the flood gates for a refinancing boom that is likely to last for several years,” said Frank Martell, president and CEO of CoreLogic. “In addition, after a momentary COVID-19-induced blip, purchase demand has picked up, driven by low rates and enthusiastic millennial and investor buyers. Spurred on by strong demand and record-low mortgage rates, we expect to see more home building in 2021 and beyond, which should help support a healthy housing market for years to come.”

The CoreLogic Market Risk Indicator, a monthly update of the overall health of housing markets across the country, said metro areas with an elevated resurgence of COVID-19 cases, such as Prescott, Ariz., and Miami— are at the greatest risk (above 70%) of a decline in home prices over the next 12 months. Other metro areas with a high risk of price declines include Lake Charles, La.; Huntington, W, Va., and Las Vegas.