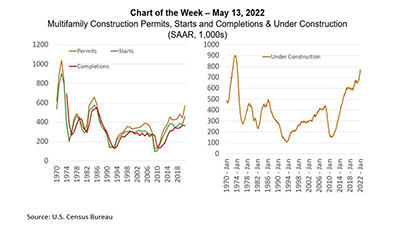

Housing markets are tight. Multifamily developers are responding. Developers are currently building 800,000 new homes in buildings with 5 or more units – the most since the mid-1970s – and will put-in-place a record $100 billion of multifamily housing construction this year.

Category: News and Trends

Tony Thompson, CMB: CCL Coaching Program Launches at NAMMBA

The secret to success in the CRA/LMI marketplace isn’t a formula. It isn’t banging your head on the proverbial brick wall hoping for a breakthrough. And it isn’t trying the same old tactics in the hope that something sticks. It’s a combination of knowledge and becoming a part of the community you serve.

People in the News May 17, 2022: PGIM Real Estate Names Christy Lockridge Chief DEI Officer

PGIM Real Estate appointed Christy Lockridge as its chief diversity, equity and inclusion officer, based in Chicago. She will build upon the firm’s expanded commitment to advancing diversity, equity and inclusion and will lead the business’s first formal DEI office.

George Baker of Talk’uments: In Spite of Storm Clouds, Genuine Opportunities Emerging for Lenders

The virtually untapped and growing market of Limited English Proficiency borrowers deserves consideration and investment, and promises real potential for lenders which do.

Howard Lin of Cielway: How to Manage Mortgage Servicing Rights in This Fast Market

Mortgage servicing rights are a natural hedge to those who primarily focus on the origination side of the business. However, retaining servicing rights is not an easy business, not to mention properly valuing them, especially when the current volatile interest rate movement makes hedging a task only to the most sophisticated mind.

MBA Advocacy Update May 16, 2022

On Wednesday night, Julia Gordon was confirmed by the Senate to be the Assistant Secretary for Housing and FHA Commissioner at HUD. MBA President and CEO Bob Broeksmit, CMB, penned a new blog post discussing how policymakers can empower mortgage lenders to deliver more relief to borrowers.

MBA Advocacy Update May 16, 2022

On Wednesday night, Julia Gordon was confirmed by the Senate to be the Assistant Secretary for Housing and FHA Commissioner at HUD. MBA President and CEO Bob Broeksmit, CMB, penned a new blog post discussing how policymakers can empower mortgage lenders to deliver more relief to borrowers.

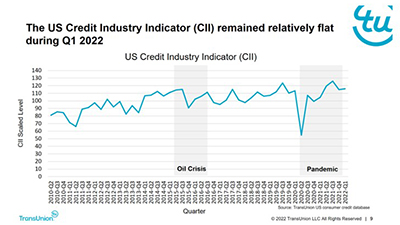

Despite Challenges, 1Q Consumer Credit Health Stays Strong

Rising interest rates and increased prices of goods and services placed pressure on the consumer wallet in the first quarter. Despite the challenges, consumers remain well positioned from a consumer credit perspective, according to the Quarterly Credit Industry Insights Report from TransUnion, Chicago.

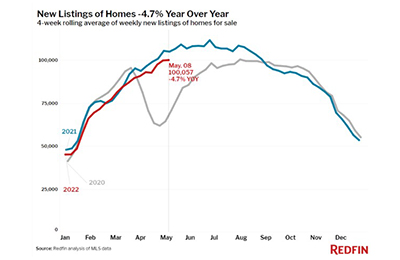

Redfin: Shrinking Pool of Buyers Snatch Up Homes at Record Pace

Demand for homes is falling, but homes are still selling fast as the buyers who remain rush to beat rapidly rising mortgage rates, said Redfin, Seattle.

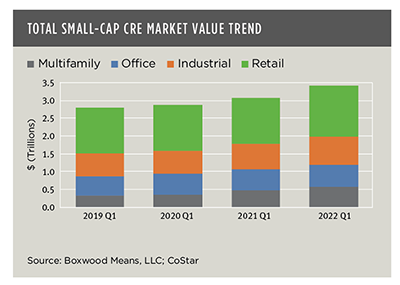

Small-Cap CRE Market Value Reaches $3.4T

The small-cap commercial real estate market has grown to $3.4 trillion in dollar value, reported Boxwood Means LLC, Stamford, Conn.