MBA Chart of the Week May 13, 2022: Multifamily Construction

Housing markets are tight. Multifamily developers are responding.

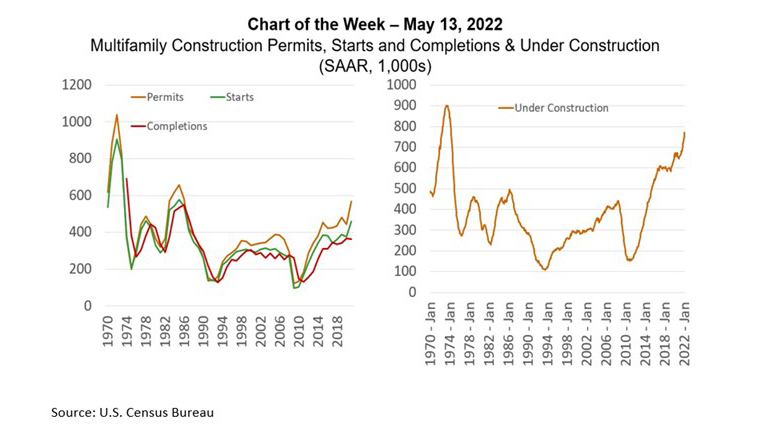

Developers are currently building 800,000 new homes in buildings with 5 or more units – the most since the mid-1970s – and will put-in-place a record $100 billion of multifamily housing construction this year.

In recent months, MBA’s Chart of the Week has presented data (on vacancy rates) that demonstrates that the US housing market is essentially full. We’ve also shown (through MBA’s new Purchase Application Payment Index (PAPI)) that those tight market conditions have pushed both home prices and rents higher.

The resulting increase in multifamily property values — up more than 20 percent over the last year — means that new construction projects that previously would not have made economic sense now “pencil-out.” The new housing that private developers are building will add to the supply, push up on vacancy rates and act as a counter-balance to rising rents.

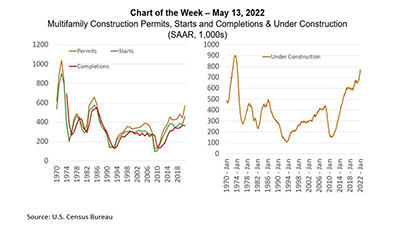

The latest numbers from the Census Bureau’s data on housing permits, starts and completions show developers received permits for 566,000 multifamily units in 2021, started construction on 460,000 units and completed 364,000 units. Completions have slowed somewhat in recent months because of supply-chain disruption, but the permits and starts numbers are 60% and 53% percent higher, respectively, than what they averaged during the 2010s. The 800,000 multifamily units currently under construction are the most since the mid-1970s.

Another series from Census shows the value of new multifamily construction put-in-place by developers is running above an annual pace of $100 billion. For comparison purposes, HUD’s FY2021 budget included $25 billion for tenant-based rental assistance, and $13.5 billion for project-based assistance. The Low-Income Housing Tax Credit (LIHTC), the largest federal housing development program, provides roughly $10 billion a year to subsidize new construction.

The supply constrained housing market is the result of years of under-development and a demographically driven surge in demand, and government support is inadequate. New development won’t solve the challenges overnight or be able to address the needs of households that do not earn enough to support the cost of building and maintaining safe, decent housing.

The good news? (Largely) left to its own devices, the private development market is responding to today’s housing challenges in a way federal programs – absent a truly historic investment – never could.

Jamie Woodwell jwoodwell@mba.org.