In another effort to promote enforcement of consumer protection laws, the Consumer Financial Protection Bureau last week issued an interpretive rule that supports states’ authorities to pursue lawbreaking companies and individuals that violate provisions of federal consumer financial protection law.

Category: News and Trends

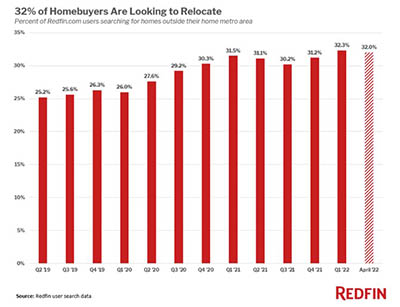

More Willing to Relocate to Buy Affordable Home

Homebuyers—particularly first-time buyers squeezed by competition and soaring home prices—are considering many options, including relocating to other parts of the country, said Bankrate, New York. And according to a similar report from Redfin, Seattle, migrating could be their best option.

Dealmaker: Q10 Triad Capital Advisors Arranges $78M

Q10 Triad Capital Advisors, Kansas City, arranged $78 million in long-term fixed-rate financing for 46 Penn Centre in Kansas City, Mo.

Call for Speakers: MBA Annual Convention & Expo; Deadline June 15

Speaking proposals for breakout sessions are now being accepted for the Mortgage Bankers Association’s Annual Convention & Expo 2022, taking place October 23-26 at Music City Center in Nashville.

MBA CREF Market Intelligence Symposium June 15-16

The Mortgage Bankers Association’s annual CREF Market Intelligence Symposium takes place June 15-16.

MBA Advocacy Update May 23, 2022

On Wednesday, MBA Vice Chair Mark Jones testified before the House Veterans’ Affairs Subcommittee on Economic Opportunity in support of bicameral VA appraisal modernization legislation introduced by Rep. Mike Bost, R-Ill., and Sen. Dan Sullivan, R-Alaska.

People in the News May 24, 2022: Appraisal Logistics Taps Elizabeth Green as Chief Strategy Officer

Appraisal Logistics, Annapolis, Md., named Elizabeth Green as Chief Strategy Officer.

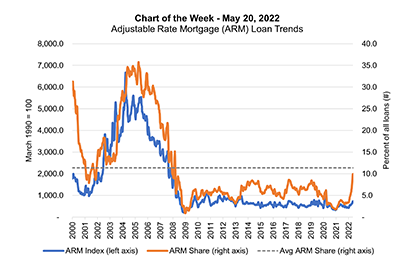

MBA Chart of the Week May 20, 2022: ARM Loan Trends

The recent increase in the adjustable-rate mortgage share of applications has caught the attention of market participants and the media. The ARM share has increased from 3.1 percent in the first week of January to 10.3 percent as of the week ending May 13, peaking at 10.8 percent the week prior.

Chris Joles of Planet Home Lending: How Should Mortgage Bankers Measure Climate Risk?

Whether or not you personally believe climate change exists, the White House, federal regulators, states and even other countries are clearly signaling that mortgage companies need to measure climate risks.

Quote

“Many buyers are facing the harsh reality that they can’t afford to buy in the neighborhood they really want. In some cases, buyers are deciding to move out of the most challenging markets.”

–Bankrate Chief Financial Analyst Greg McBride.