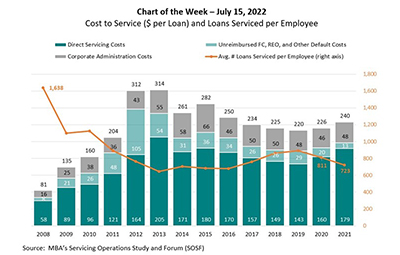

MBA’s annual Servicing Operations Study and Forum includes a deep-dive analysis and discussion of servicing costs, productivity, portfolio activity and operational metrics for in‐house servicers. This week’s MBA Chart of the Week shows 2021 fully loaded servicing costs, which include three components: direct expenses; unreimbursed foreclosure, REO and other default costs; and corporate administration costs.

Category: News and Trends

Dealmaker: Sonnenblick-Eichner Co. Arranges $50M for California Resort

Sonnenblick-Eichner Co., Beverly Hills, Calif., arranged $50 million in acquisition financing for the Inn at Rancho Santa Fe, an 82-room resort in north San Diego County, Calif.

Jim Rosen of Mortgage Cadence: How the Right Services Strategy Promotes Loan Origination Efficiency

im Rosen is Executive Vice-President of Services at Mortgage Cadence and has more than 20 years of experience in the mortgage software and services industry. He has been with Mortgage Cadence for nearly eight years and was instrumental in launch of the company’s new MCP loan origination platform.

The Week Ahead, July 18, 2022: Five Things to Know

Good morning and happy Monday! Here’s what’s happening this week:

mPowering You: MBA’s Summit for Women in Real Estate Finance in Nashville Oct. 22

mPowering You: MBA’s Summit for Women in Real Estate Finance, takes place Saturday, Oct. 22 in Nashville, Tenn., ahead of the MBA Annual Convention & Expo.

Jeff Coles of Berkadia on Single-Family Rental/Built-for-Rent Markets

Jeff Coles is Vice President of Institutional Client Services with Berkadia, Washington, D.C. He leads Berkadia’s Single-Family Rental & Built-for-Rent specialty.

Quote

“A fear has been that LIHTC properties would simply jack up rents to the top of the market at the expiration of their rent and income restrictions, generally about 30 years, but that’s not usually the case. Any loss of units affordable to the lowest income renters is concerning, but there is some consolation in that LIHTC properties typically continue to serve low- and middle-income renters.”

–Steve Guggenmos, Vice President of Research & Modeling with Freddie Mac, McLean, Va.

Joe Ludlow of Advantage Systems: The Importance of Tracking Every Dime in a Rising-Rate, Recessionary Mortgage Market

The reality is that most lenders will see their volumes drop regardless of what they do, so they are also looking for additional strategies for staying profitable; one place to affect meaningful change is in lowering existing operational costs.

People in the News July 18, 2022: Akerman Adds Nailah Tatum as Partner in Tallahassee

Akerman LLP announced expansion of its Real Estate Practice Group with partner Nailah Tatum in Tallahassee, Fla.

Chayan Jagsukh of Tavant: Borrower Data Privacy: The Unsung Differentiator

With the vast amount of information required to approve a mortgage/home loan, it’s the responsibility of the lenders to ensure that the privacy of the information collected from the borrower is maintained.