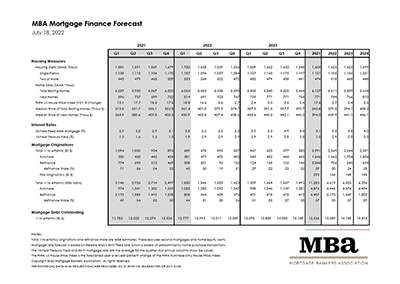

The Mortgage Bankers Association released updated Economic and Mortgage Market forecasts Thursday.

Category: News and Trends

MBA Premier Member Profile: Salesforce

Salesforce is the #1 CRM, bringing companies and customers together in the digital age.

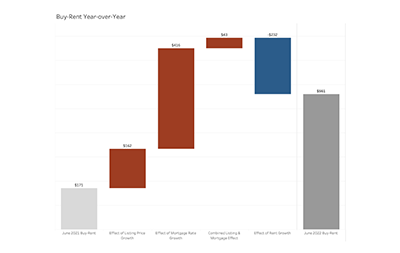

Renting More Affordable than Buying Starter Home in Most Large Cities

Higher mortgage rates are increasingly tipping the housing affordability scale in favor of renting over first-time buying, the National Association of Realtors reported.

8 Common Fair Lending Compliance Myths Debunked

Michael Berman is Founder & CEO of Ncontracts, Brentwood, Tenn. Ncontracts provides integrated risk management and lending compliance software to a rapidly expanding customer base of over 4,000 financial institutions, fintechs and mortgage companies in the United States.

MBA Home For All Pledge Partner: United Community Bank

(One in a series of profiles of MBA member companies that have signed the MBA Home For All Pledge, an initiative to promote inclusion in housing.)

Few Mortgage Innovations Actually Save Lenders Money. eClosing is One of Them.

Joe Garrett is Principal with Garrett, McAuley & Co., a banking and mortgage banking consulting firm that helps lenders increase revenues, control costs and better manage risk.

MBA Advocacy Update July 25 2022

Some activities of note during a busy week on Capitol Hill.

MBA Human Resources Symposium Sept. 8-9

The Mortgage Bankers Association’s annual Human Resources Symposium takes place Sept. 8-9 in Arlington, Va.

MISMO Issues Call for Participants For New Housing Counseling Workgroup

MISMO®, the real estate finance industry standards organization, issued a call for participants for a new development workgroup focused on creating a unified dataset aimed at making the housing counseling process more efficient and effective for borrowers and lenders with the goal of facilitating greater access to homeownership.

The Week Ahead, July 25, 2022: Five Things to Know

Good morning and happy Monday! Here’s what’s happening this week: