HUD yesterday announced a series of steps aimed at boosting housing supply, particularly in areas with minority borrowers.

Category: News and Trends

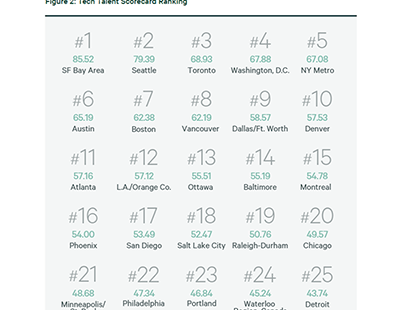

CBRE: Tight Labor Market, Remote Work Changing Growth Patterns

The U.S. added 136,000 new high-tech jobs last year in hubs including the Bay Area, New York and Seattle as well as Nashville, Cleveland and other smaller markets, reported CBRE, Dallas.

Dealmaker: Lument Closes $117M Freddie Mac Loan for Brooklyn Affordable Portfolio

Lument, New York, closed a $117.4 million Freddie Mac unfunded forward loan for Hope Gardens, a portfolio of affordable housing communities in Brooklyn, N.Y.

Joe Ludlow of Advantage Systems: The Importance of Tracking Every Dime in a Rising-Rate, Recessionary Mortgage Market

The reality is that most lenders will see their volumes drop regardless of what they do, so they are also looking for additional strategies for staying profitable; one place to affect meaningful change is in lowering existing operational costs.

NAMMBA Presents CONNECT 2022 in Orlando Sept. 15-17

NAMMBA, the National Association of Minority Mortgage Bankers of America, holds its annual CONNECT 2022 Conference Sept. 15-17 at the JW Marriott Bonnet Creek Resort & Spa.

MBA Risk Management, QA and Fraud Prevention Forum in Nashville Sept. 11-13

The Mortgage Bankers Association’s annual Risk Management, QA and Fraud Prevention Forum takes place Sept. 11-13 at the Grand Hyatt Nashville.

People in the News July 15, 2022: Akerman Adds Nailah Tatum as Partner in Tallahassee

Akerman LLP announced expansion of its Real Estate Practice Group with partner Nailah Tatum in Tallahassee, Fla.

Quote

“Tech talent and the broader technology industry have time and again proven resilient amid economic cycles. We’ve seen in the past that, when the tech industry retrenches, companies tend to eliminate support jobs in favor of retaining their tech talent. Meanwhile, North American tech markets continue to produce innovations that draw customer demand.”

–Colin Yasukochi, Executive Director of CBRE’s Tech Insights Center, San Francisco.

Chayan Jagsukh of Tavant: Borrower Data Privacy: The Unsung Differentiator

With the vast amount of information required to approve a mortgage/home loan, it’s the responsibility of the lenders to ensure that the privacy of the information collected from the borrower is maintained.

Jeff Flory, CMB, AMP, of Baker Tilly: CFPB Increases Scrutiny of Mortgage Servicers as Pandemic Emergency Eases

It is not surprising that the CFPB has increased its scrutiny of mortgage servicers, particularly as the industry moves from a COVID-19 pandemic-induced emergency state to a more normalized servicing environment.