CBRE: Tight Labor Market, Remote Work Changing Growth Patterns

The U.S. added 136,000 new high-tech jobs last year in hubs including the Bay Area, New York and Seattle as well as Nashville, Cleveland and other smaller markets, reported CBRE, Dallas.

In the U.S., technology talent jobs grew nearly 2.5 percent last year, matching non-tech job growth, CBRE said in its annual Scoring Tech Talent report. Amid the economic turmoil of 2020, tech talent registered a 0.8 percent job gain compared to 5.5 percent decline for non-tech jobs.

The tech industry’s impact on U.S. office leasing also dipped in recent years and then recovered, going from 21 percent in 2019 to 17 percent in 2020 and back to 21 percent last year.

“Tech talent and the broader technology industry have time and again proven resilient amid economic cycles,” said Colin Yasukochi, Executive Director of CBRE’s Tech Insights Center in San Francisco. “We’ve seen in the past that, when the tech industry retrenches, companies tend to eliminate support jobs in favor of retaining their tech talent. Meanwhile, North American tech markets continue to produce innovations that draw customer demand.”

Yasukochi noted the recent trend toward increased remote hiring can spread technology talent job growth across more numerous markets nationwide.

Growth in tech talent professions and industries was widespread last year, CBRE said. The industries that added the most tech talent included the technology sector (110,300 jobs), life sciences (37,800) and the financial services, insurance and real estate category (18,900).

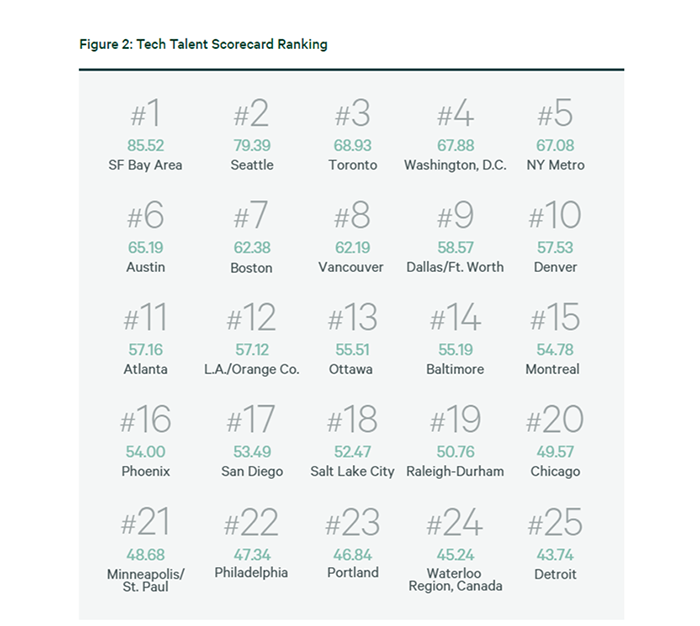

CBRE noted the top North American tech talent markets did not vary from last year. The top tech markets include the Bay Area, Seattle, Toronto, Washington, D.C. and New York. Smaller markets including Pittsburgh, Charlotte, Orlando and Madison, Wis. topped the second tier of tech markets.

The report also examined the most and least expensive tech markets. The most expensive market among the top 50 for a 500-person technology company leasing 75,000 square feet is the Bay Area at $69.2 million in combined annual real estate and labor costs. The least expensive is Quebec City at $32.1 million.

Looking at office asking rents, New York ranked as the most expensive at $77.45 per square foot per year and Cleveland was the least expensive among the top 50 at $18.71. Housing affordability is a consideration for both employers and technology workers, and New York registered the highest ratio of annualized apartment rent to average tech wage at 32 percent, while Montreal ranked lowest at 12.9 percent.