According to a 2019 McKinsey study, lack of production data is the number one cause of poor hiring decisions across the mortgage industry.

Category: News and Trends

The Week Ahead, Aug. 8, 2022: Five Things to Know

Good morning and happy Monday! Hope you are staying cool in your neck of the woods. Here’s what’s happening this week:

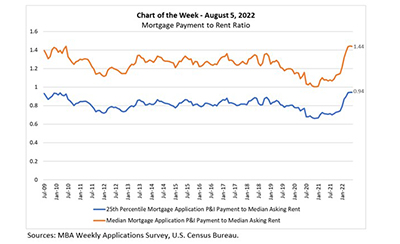

MBA Chart of the Week Aug. 8, 2022: Mortgage Payment to Rent Ratio

This MBA Chart of the Week examines the relationship between mortgage payments and asking rents since the second half of 2009. MBA’s national mortgage payment to rent ratio compares the national median and 25th percentile mortgage payments to the national median asking rent.

Rita Moreno Keynotes mPower Event at MBA Annual22

Rita Moreno–Academy Award-winning actress, dancer and singer and recipient of the Presidential Medal of Freedom–keynotes the mPower Event at the Mortgage Bankers Association in Nashville, Tenn.

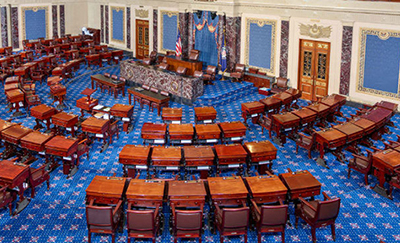

Senate Dems Drop MBA/Trade Group-Opposed Carried Interest Provision in Reconciliation Bill

Senate Democrats late Thursday dropped a controversial carried interest provision in a reconciliation bill that the Mortgage Bankers Association and other industry trade groups said would “cripple the housing recovery.”

Quote

“Despite the negative reading on second quarter GDP, this is not a picture of an economy in recession. And even though initial claims for unemployment insurance have increased modestly in recent weeks, these data show that the pace of hiring, spurred by more than 10 million job openings, continues to exceed any increase in layoffs.”

–Mike Fratantoni, Chief Economist with the Mortgage Bankers Association.

MISMO Seeks Public Comment on Business Glossary, eMortgage Glossary, Digital Loan Modification Flyer

MISMO®, the real estate finance industry standards organization, seeks public comment on three key industry resources to help accelerate the industry’s digital transformation.

Mark P. Dangelo: In Perspective, the Fragmentation of the Mortgage Industry

Reimaging of the mortgage markets has begun—driven by shrinking margins, rising rates, and inflationary pressures. Yet, for all the actions since 2010 involving data standards, digital transformations, and customer experiences, what is missing? Who will be left standing as the next cycle takes form and the mortgage industry is digitally reimaged?

Marvin Chang of Mortgage Hippo: Three Reasons Lenders Must Lean Into Innovation

Lenders that hunkered down during the last two major industry downturns are no longer in the business, while those that leaned in and innovated during the same period emerged as industry leaders. Now is not the time for timidity. In fact, leading lenders are leaning into innovation now. There are at least three good reasons to do so.

Jim Paolino of Lodestar: By the Numbers–Did Increased WFH Opportunities Help Spur Home Buying in Metro Suburbs?

Two years after the height of the COVID lockdown, there’s lots of new data available to prove (or disprove) some of the early predictions and observations regarding home buying patterns and trends.