One in a continuing series of profiles of Premier Members of the Mortgage Bankers Association. Please contact MBA’s Alicia Goncalves, CMB for information about Premier Member spotlights.

Category: News and Trends

ATTOM: Homes Grow Less Affordable

The median home price reached a new high of $375,000 in the third quarter, according to ATTOM, Irvine, Calif.

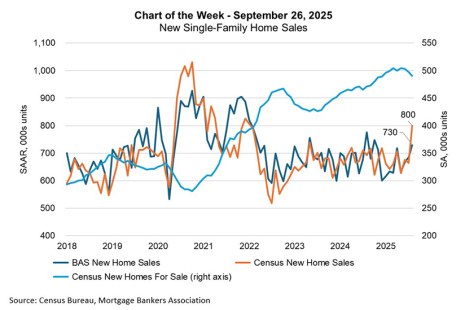

Chart of the Week: New Single-Family Home Sales

MBA’s estimate of new home sales, based on a larger sample than the one used by the Census Bureau, suggests that the increase in new home sales was smaller in August than Census calculated.

Why Intelligent Integration Is the Mortgage Industry’s Next Competitive Edge

Argyle’s John Hardesty says the next phase of digital transformation is intelligent integration: the purposeful connection of systems so data can move freely and every tool adds measurable value rather than complexity.

Dealmaker: JLL Secures $39M for Savannah Townhomes

JLL Capital Markets arranged $38.7 million in financing for Clear Lake Reserve Townhomes, a 199-unit for-rent townhome community in Pooler, Ga.

New Home Sales Rise in August Due to More Supply, Zonda Reports

The new home market saw a modest 2.1% month-over-month increase in total transactions in August, according to Zonda, Newport Beach, Calif.

Existing-Home Sales Dip in August

Existing-home sales remained essentially the same in August, ticking down just 0.2% from July, according to the National Association of Realtors, Chicago.

Mortgage Application Payments Decrease in August

Homebuyer affordability improved in August, with the national median payment applied for by purchase applicants decreasing to $2,100 from $2,127 in August, according to MBA’s Purchase Applications Payment Index.

MBA Opens Applications for Associate Advisory Council

MBA is now accepting applications for open seats on the MBA Associate Advisory Council, an industry leadership group dedicated to representing the interests and elevating the contributions of Associate Members.

ICE First Look: Delinquencies Up; Foreclosure Activity Slowly Trending Higher

The national mortgage delinquency rate rose in August–largely driven by a calendar anomaly–while foreclosure activity continued its slow upward trend, ICE Mortgage Technology reported Wednesday.