Total nonfarm payroll employment rose by a better-than-expected 266,000 in November, the Bureau of Labor Statistics reported Friday.

Category: News and Trends

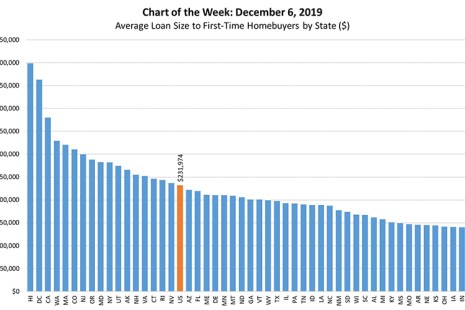

MBA Chart of the Week: Average Loan Size to First-Time Home Buyers

On average, the size of a first-time home buyer’s mortgage was $231,974 in the first three quarters of 2018, based on loan acquisitions data from Fannie Mae and Freddie Mac. This represents a 4.2% increase over the average size of $223,000 for mortgages to first-time home buyers originated in 2017 and an acceleration from the 1.8% annual gain in 2016.

Financial Stability Oversight Council Annual Report Describes ‘Emerging Threats’ to U.S. Financial Stability

The Financial Stability Oversight Council issued its 2019 Annual Report, which outlines “significant financial market and regulatory developments” and “potential emerging threats to U.S. financial stability.”

FHA Raises 2020 Forward, Reverse Loan Limits

The Federal Housing Administration published Mortgagee Letter 2019-19 and Mortgagee Letter 2019-20, which raises the maximum mortgage limits for FHA-insured Title II forward mortgages and Home Equity Conversion Mortgages.

MBA Premier Member Profile: LoanLogics

LoanLogics, Trevose, Pa., is a recognized leader in loan quality management technology and services for mortgage manufacturing and loan acquisition.

Wolters Kluwer: ‘Substantial Risk, Compliance Concerns’ Remain for U.S. Lenders

Wolters Kluwer, Minneapolis, issued its 2019 Regulatory & Risk Management Indicator, which noted despite a 10-point improvement from 2018, “notable” regulatory compliance and risk challenges remain high in a number of key areas for U.S. banks and credit unions.

MBA: 3Q Commercial/Multifamily Mortgage Delinquencies Stay Low

Commercial and multifamily mortgage delinquencies remained low in the third quarter, according to the Mortgage Bankers Association’s quarterly Commercial/Multifamily Delinquency Report.

Millennial Refinance Activity Hits 2019 Peak; Home Prices Growth Fastest in 6 Years

Ellie Mae, Pleasanton, Calif., said the share of refinances closed by millennials in October increased to a new high as interest rates on 30-year loans fell.

MISMO To Update Appraisal Data Standards

MISMO, the mortgage industry standards organization, invites the mortgage industry to participate in an effort to enhance its residential appraisal data standards. This effort will evaluate new types of property information that may be useful to the industry.

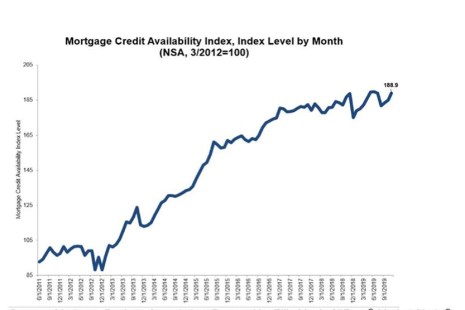

November MBA Mortgage Credit Availability Index Up 2.1%

Mortgage credit availability rose for the third straight in November, according to the Mortgage Bankers Association’s Mortgage Credit Availability Index.