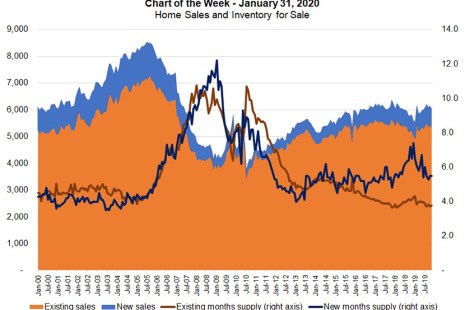

This week’s chart highlights longer-term trends in home sales and inventory of homes on the market.

Category: News and Trends

Empowering Women Requires Societal Influence

Hiring for diversity is not enough – to succeed, inclusion and diversity need to be woven into the fabric of our offerings. It needs to be a mindset change, not a superficial checkbox.

People in the News

DIMONT, Dallas, promoted Laura MacIntyre to CEO, responsible for the company’s strategic initiatives, business development and client relations and ensure alignment of the organization to grow its new business segments.

FHFA Proposes Updated Minimum Financial Eligibility Requirements for Fannie Mac/Freddie Mac Seller/Servicers

The Federal Housing Finance Agency on Friday proposed updated minimum financial eligibility requirements for Fannie Mae and Freddie Mac Seller/Servicers.

MBA Advocacy Update

On Friday MBA submitted a letter responding to HUD’s RFI on housing affordability, urging HUD to pursue a number of regulatory and federal funding reforms intended to spur housing supply, lower costs and enhance affordability. Also last week MBA submitted a letter to the House Energy and Commerce Committee highlighting the association’s principles for privacy and cybersecurity reform. And on Wednesday, Comptroller Joseph Otting testified before the House Financial Services Committee on the OCC’s joint plan with the FDIC to revamp CRA.

Radian: 2019 Home Price Gains Highest in More than a Decade

Radian, Philadelphia, said home prices across the United States rose by nearly 7 percent in 2019, the largest annual increase since 2006.

MBA Chart of the Week: Home Sales and Inventory for Sale

This week’s chart highlights longer-term trends in home sales and inventory of homes on the market.

The Week Ahead

NEW ORLEANS—MBA NewsLink comes to you this week from the Mortgage Bankers Association’s Independent Mortgage Bankers Conference here in The Big Easy.

People in the News

DIMONT, Dallas, promoted Laura MacIntyre to CEO, responsible for the company’s strategic initiatives, business development and client relations and ensure alignment of the organization to grow its new business segments.

Empowering Women Requires Societal Influence

Hiring for diversity is not enough – to succeed, inclusion and diversity need to be woven into the fabric of our offerings. It needs to be a mindset change, not a superficial checkbox.