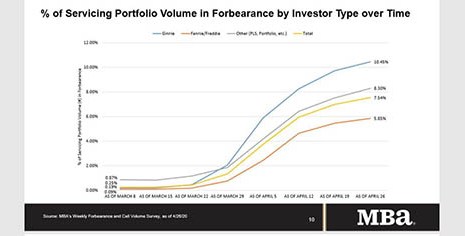

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed the number of loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, a total of 3.80 million homeowners are now in forbearance plans.

Category: News and Trends

People in the News

Homespire Mortgage, Gaithersburg, Md., announced Shondra B. Jenkins joined its team as Director of Philanthropy and Community Engagement, to further develop and enhance its corporate social responsibility programs and outreach.

Brenda Colter: Branch Advocacy Beyond Onboarding is Just the First Step

Joining a new company can be stressful and exciting all at the same time. After a mortgage loan originator gets their new equipment and completes training, the excitement might wear off, but the need for explanations, connections and support remains. That’s why we need branch advocates who step in and support branches after onboarding concludes.

MBA Education Path to Diversity Scholar Profile: Christa Thomas

One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.

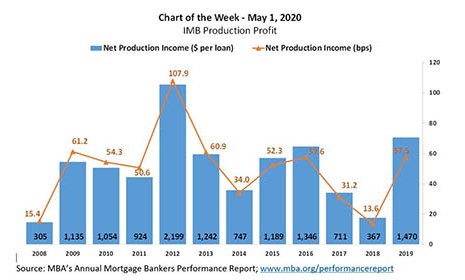

MBA Chart of the Week: IMB Production Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported average pre-tax production profits of 58 basis points ($1,470 on each loan they originated) in 2019, up from 14 basis points ($367 per loan) in 2018, according to the MBA Annual Mortgage Bankers Performance Report, released last month.

MISMO Issues Standardized Closing Instructions

MISMO, the Mortgage Industry’s Standards Maintenance Organization, announced issuance of standardized closing instructions.

MBA Advocacy Update

MBA continues to advocate for the industry to help MBA members address the financing needs of their customers during the ongoing pandemic and will provide updates as they become available. Several updates pertaining to COVID-19, along with other industry activities, are included in this week’s communication.

Ginnie Mae Begins Publishing PTAP/C19 Data

Ginnie Mae, Washington, D.C., on May 1 published the first set of data related to its expanded Pass-Through Assistance Program (PTAP/C19), developed in response to the COVID-19 pandemic.

MBA Advocacy Update

MBA continues to advocate for the industry to help MBA members address the financing needs of their customers during the ongoing pandemic and will provide updates as they become available. Several updates pertaining to COVID-19, along with other industry activities, are included in this week’s communication.

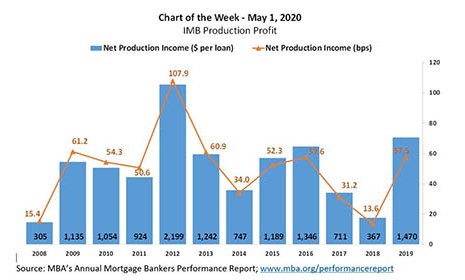

MBA Chart of the Week: IMB Production Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported average pre-tax production profits of 58 basis points ($1,470 on each loan they originated) in 2019, up from 14 basis points ($367 per loan) in 2018, according to the MBA Annual Mortgage Bankers Performance Report, released last month.