The Consumer Financial Protection Bureau, Federal Housing Finance Agency and HUD yesterday launched a new mortgage and housing assistance website designed to ensure homeowners and renters have current and accurate housing assistance information during the COVID-19 national emergency.

Category: News and Trends

Dealmaker: JLL Arranges $85M

JLL Capital Markets, Chicago, arranged $85.2 million for retail and condominium properties in Boulder, Colo. and Miami.

People in the News

Planet Home Lending LLC, Meriden, Conn., promoted Kathy Keller to SVP of Strategic Initiatives and hired Mike Eckrote as SVP of Quality Control and Christopher Joles as SVP and Enterprise Risk Officer.

Mark Dangelo: Innovation Thinking—Winning in an Uncertain Future

The financial services and mortgage industries have not felt the full impact and unintended consequences of COVID-19 and the governmental interventions. The result will be that innovation disruption moving forward will be not be kind, will not be benevolent, and will not be industry friendly.

MBA Reports Rise in 1st Quarter Mortgage Delinquencies

Mortgage delinquencies rose in the first quarter as the economic effects of the coronavirus pandemic began to take hold, the Mortgage Bankers Association reported this morning.

Senate Approves Montgomery HUD Nomination; Dana Wade FHA Nomination Next Up

It seemed like it took forever—and in political terms, seven months feels like forever—but Brian Montgomery is finally, officially, HUD Deputy Secretary.

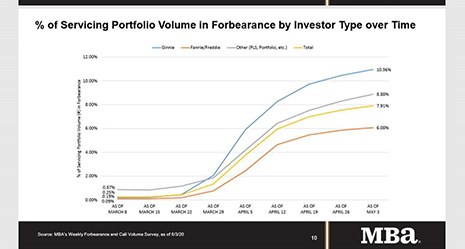

MBA: Share of Mortgage Loans in Forbearance Increases to 7.91%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased from 7.54% of servicers’ portfolio volume in the prior week to 7.91% as of May 3. MBA now estimates 4 million homeowners are now in forbearance plans.

MBA Premier Member Profile: Richey May

Richey May, Englewood, Colo., is an accounting and business consulting firm, focused on the mortgage banking industry. Our diverse offerings include Audit, Tax, Accounting, Business Advisory and Technology Consulting. Founded in 1985, our specialized approach allows us to serve our clients at a high level, with many service leaders holding previous experience at mortgage companies.

Matt Clarke: How Technology Can Enhance Borrower’s Experience by Supporting Lender

As the industry becomes increasingly digital, mortgage professionals must find a way to survive and keep up with demand at rapid speed. Unfortunately, the latest and greatest technology comes at a price. To truly succeed, mortgage professionals need to determine strategies that reduce expenses while offering a convenient relationship-based mortgage experience for borrowers.

Scott Roller: Remote Online Notarization – Navigating the Icebergs

Necessity is the mother of all invention, so the saying goes. No, not exactly true here. RON was already being deployed in pockets across the industry pre-coronavirus. Therefore, its more appropriate to proclaim, “perplexing problems produce instant popularity where past procrastination persisted.” Said more plainly – nothing is more white-hot than RON right now, and everyone suddenly cannot live without it. Demand far-outstrips supply by a factor too large to contemplate.