Enterprise Community Development, Columbia, Md., and Fellowship Square Foundation, Reston, Va. received $86 million to build the new Lake Anne House in Reston, Va. outside Washington, D.C.

Category: News and Trends

HUD/Census: Nearly Half of Rental Units Are in Small Multifamily Properties

Nearly half of the nation’s 48.2 million rental housing units are in properties with less than five units, HUD and the U.S. Census Bureau reported. For these small rental properties, …

(#MBALive) Closing Loans During a Pandemic With RIN and RON

Enterprising mortgage companies are using what they have to ensure consumers can still obtain loans during the COVID-19 crisis.

Analysts: Missing Spring Home Sales to Disperse over ‘Years’

When the coronavirus pandemic turned the economy upside down, anxiety and uncertainty about the future initially kept many home buyers and sellers at bay. Inventory and sales have picked up over the past month, though, and a panel of housing experts and economists sponsored by Zillow, Seattle, say the U.S. housing market hasn’t lost those missing springtime transactions for good. But it could take years for a full recovery.

The Week Ahead: June 8, 2020

Good morning! Welcome to Month Four of the Coronapocalypse. This afternoon, the Mortgage Bankers Association releases its weekly Forbearance & Call Volume Report at 4:00 p.m. ET; MBA NewsLink will provide a special afternoon issue with the results.

People in the News June 8 2020

ServiceLink, Pittsburgh, Pa., appointed Yvette Gilmore as senior vice president of servicing product strategy. She will be responsible for developing ServiceLink’s products and services that support strategic servicer client initiatives. She will also support ServiceLink’s EXOS One Marketplace.

Q&A With M&T Realty Capital’s Michael Berman, CMB, and Jeffrey Rodman

MBA NewsLink interviewed M&T Realty Capital Corporation President & CEO Michael Berman, CMB, and Affordable Housing Program Manager Jeffrey Rodman about MTRCC’s business lines and affordable housing efforts.

FHA, CFPB Issue New Guidance on Forbearance

The Federal Housing Administration and the Consumer Financial Protection Bureau yesterday each announced new policies to assist mortgage borrowers impacted by the economic effects of the coronavirus pandemic.

(#MBALive) Closing Loans During a Pandemic With RIN and RON

Enterprising mortgage companies are using what they have to ensure consumers can still obtain loans during the COVID-19 crisis.

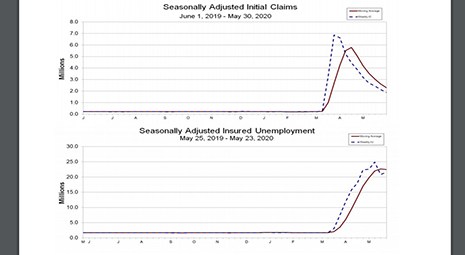

Americans File 1.9 Million Initial Claims; 11-Week Total at 42.6 Million

The positive news is initial unemployment claims fell for the ninth consecutive week. The not-so-positive: nearly 28 percent of Americans who had jobs in February are now out of work.