SAN DIEGO–A 7 percent increase in commercial and multifamily mortgage originations in the fourth quarter capped off a strong 2019 for the market, according to preliminary estimates from the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Category: News and Trends

Mark P. Dangelo: The Challenges of Reskilling Workforces, Part 2

During an age of mass economic disruption and customer reorientation, innovative leaders will wrestle not only with the challenges of reskilling existing workforces, but also must filter every initiative through politics, social chaos and industry axioms if they are to add clarity to the Innovation Predicament.

MBA Updates Documents on IMB Advocacy

The Mortgage Bankers Association issued updated versions of two documents that illustrate the association’s ongoing efforts to highlight the vital role of independent mortgage banks in the mortgage industry.

MBA Advocacy Update

On Thursday Consumer Financial Protection Bureau Director Kathy Kraninger provided her semi-annual testimony before the House Financial Services Committee. During the hearing, Kraninger addressed questions regarding the “QM Patch” and HMDA reporting.

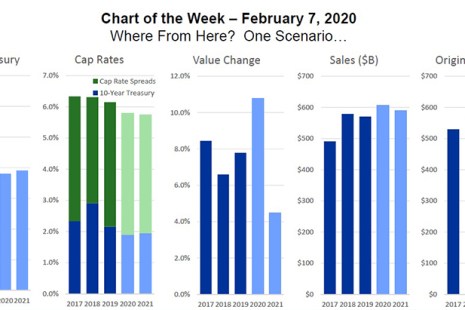

MBA Chart of the Week: Where from Here? One Scenario

On Sunday, we kicked off CREF 2020–MBA’s 2020 Commercial Real Estate Finance/Multifamily Housing Convention & Expo, with an economic and mortgage market update. One of the main messages: the commercial/multifamily markets ended 2019 on a very strong note.

MBA: Commercial/Multifamily Borrowing Hits New High to Close Out 2019

SAN DIEGO–A 7 percent increase in commercial and multifamily mortgage originations in the fourth quarter capped off a strong 2019 for the market, according to preliminary estimates from the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

The Week Ahead

SAN DIEGO–For the Mortgage Bankers Association, the action shifts from New Orleans following last week’s Independent Mortgage Bankers Conference, to the west coast for the MBA annual Commercial Real Estate Finance/Multifamily Housing Convention & Expo.

Gen Z Displays Strong Appetite for Credit; Millennials Refinance Less (For Now)

TransUnion, Chicago, said Generation Z consumers—those born in or after 1995—are actively seeking credit despite many of them growing up during severe economic recessions in their respective global markets.

January Jobs Report Beats Expectations

Total nonfarm payroll employment rose by 225,000 in January, beating economists’ expectations, the Bureau of Labor Statistics reported on Friday.

MBA Updates Documents on IMB Advocacy

The Mortgage Bankers Association issued updated versions of two documents that illustrate the association’s ongoing efforts to highlight the vital role of independent mortgage banks in the mortgage industry.