“With the job market beginning to gradually improve, more homeowners are exiting forbearance, and we are seeing declines in forbearance volume among some servicers.”

–MBA Chief Economist Mike Fratantoni.

“With the job market beginning to gradually improve, more homeowners are exiting forbearance, and we are seeing declines in forbearance volume among some servicers.”

–MBA Chief Economist Mike Fratantoni.

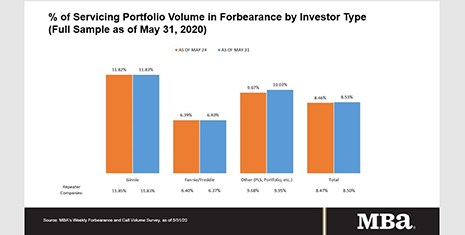

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week. MBA now estimates nearly 4.3 million homeowners are in forbearance plans.

Altisource, Luxembourg, recently hosted a Mortgage Industry Pandemic Summit, featuring six sessions and 28 speakers, to discuss the major challenges facing the industry as well as possible solutions. Now, it has published a whitepaper summarizing the summit’s key ideas, best practices, guiding principles and analyst advice, as well as results and analysis of more than 20 poll questions.

The Fannie Mae Home Purchase Sentiment Index increased by 4.5 points in May to 67.5, building slightly after nearing its record low in April. The survey indicated home buyers are much more confident in the current market than sellers.

ServiceLink, Pittsburgh, Pa., appointed Yvette Gilmore as senior vice president of servicing product strategy. She will be responsible for developing ServiceLink’s products and services that support strategic servicer client initiatives. She will also support ServiceLink’s EXOS One Marketplace.

“With the job market beginning to gradually improve, more homeowners are exiting forbearance, and we are seeing declines in forbearance volume among some servicers.”

–MBA Chief Economist Mike Fratantoni.

Chris McEntee is President of ICE Mortgage Services, Atlanta, the business unit responsible the Mortgage Electronic Registration System (MERS), which is now part of Intercontinental Exchange Inc. He serves as a Director of ICE Mortgage Services, the governing board of MERSCORP Holdings Inc. and chairs the Company’s Compliance, Governance and Risk Management Committee.

What follows are findings from a survey of senior mortgage executives I conducted in the first half of May. Due to cancelation of MBA’s National Secondary Market Conference, this survey was completed over the phone rather than face to face, as has been the case in the 23 preceding surveys done since 2008.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

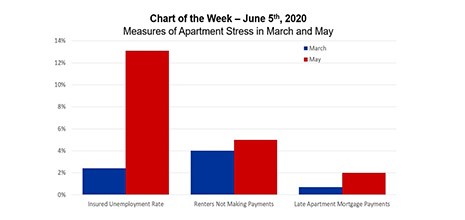

There has been an important disconnect between the labor market and apartment markets over the last two months.