Our industry’s reliance on technology is deepening every day as never-before-experienced demands emerge. For example, in a world that demands distance, the ability to perform an eClosing has evolved from nice-to-have to “essential worker” status. Lenders entering this uncharted territory may find setting internal and external eClosing protocols daunting. Whether you adopt a hybrid process or go fully digital, there are best practices consistent for each option that can ensure your successful eClosing implementation.

Category: News and Trends

Quote

“Fueled again by low mortgage rates, pent-up demand from earlier this spring and states reopening across the country, purchase mortgage applications and refinances both increased.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

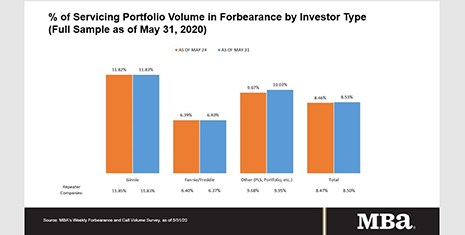

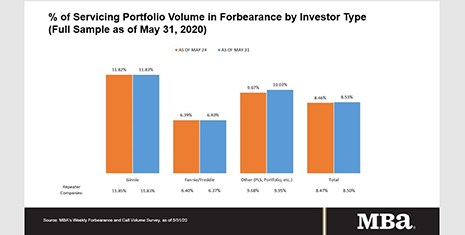

MBA Survey: Share of Mortgage Loans in Forbearance Slows to 8.53%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week. MBA now estimates nearly 4.3 million homeowners are in forbearance plans.

Chris McEntee of ICE Mortgage Services on COVID-19 and Impetus for the Digital Mortgage Process

Chris McEntee is President of ICE Mortgage Services, Atlanta, the business unit responsible the Mortgage Electronic Registration System (MERS), which is now part of Intercontinental Exchange Inc. He serves as a Director of ICE Mortgage Services, the governing board of MERSCORP Holdings Inc. and chairs the Company’s Compliance, Governance and Risk Management Committee.

People in the News June 8 2020

ServiceLink, Pittsburgh, Pa., appointed Yvette Gilmore as senior vice president of servicing product strategy. She will be responsible for developing ServiceLink’s products and services that support strategic servicer client initiatives. She will also support ServiceLink’s EXOS One Marketplace.

FHFA Announces Next Steps for GSE UMBS Pooling Practices

The Federal Housing Finance Agency yesterday directed Fannie Mae and Freddie Mac to “further align their practices for evaluating seller and servicer prepayment related activities.”

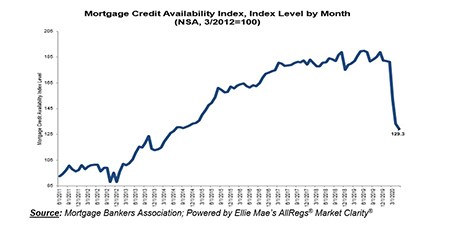

Mortgage Credit Availability Falls Again to 6-Year Low

Mortgage credit availability fell again in May, the third consecutive monthly decline, the Mortgage Bankers Association reported this morning.

Dealmaker: Capital One Closes $31M in Freddie Mac Small Balance Loans

Capital One, McLean, Va., provided Freddie Mac small balance loans totaling $31.1 million to finance nine southern California apartment communities.

Clint Salisbury: For eClosing Success, Fine Tune Implementation

Our industry’s reliance on technology is deepening every day as never-before-experienced demands emerge. For example, in a world that demands distance, the ability to perform an eClosing has evolved from nice-to-have to “essential worker” status. Lenders entering this uncharted territory may find setting internal and external eClosing protocols daunting. Whether you adopt a hybrid process or go fully digital, there are best practices consistent for each option that can ensure your successful eClosing implementation.

MBA Survey: Share of Mortgage Loans in Forbearance Slows to 8.53%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week. MBA now estimates nearly 4.3 million homeowners are in forbearance plans.