New home activity showed signs of improvement in May as the Mortgage Bankers Association’s Builder Applications Survey saw increases in activity from April and a year ago.

Category: News and Trends

Office, Industrial Broker Sentiment Improves Slightly

Industrial and office sector brokers reported slightly improved market confidence in May.

David Upbin of MBA Education on Staying Ahead of the Curve

David Upbin is Vice President of Education Operations and Programming & MBA Strategy with the Mortgage Bankers Association. He joined MBA in 2013 and is responsible for financial management, operations, delivery and programming of MBA Education’s suite of training products and events.

Dealmaker: Hunt Real Estate Capital Provides $67M In Fannie Mae, Freddie Mac Funds

Hunt Real Estate Capital, New York, provided $67 million in Fannie Mae and Freddie Mac funds for four apartment properties in the southeastern U.S. Hunt closed three Fannie Mae multifamily …

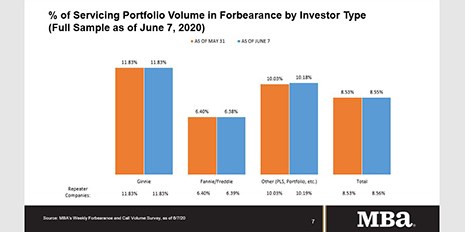

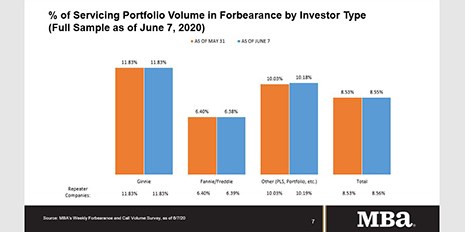

MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.

Quote

“Half of the servicers in our sample saw the forbearance share decline for at least one investor category. Although there continues to be layoffs, the job market does appear to be improving, and this is likely leading to many borrowers in forbearance deciding to opt out of their plan.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

MISMO Looks to Standardize Data Used to Guide Borrower Outreach

MISMO®, the mortgage industry standards organization, said it will evaluate the need for standards to facilitate early identification of loans that may become delinquent or be in distress.

MBA Advocacy Update

On Tuesday, HUD Secretary Ben Carson and FHFA Director Mark Calabria testified before the Senate Banking Committee about how their agencies are assisting homeowners and renters during the COVID-19 pandemic. On Wednesday, MBA along with several industry trade and housing advocacy organizations sent a letter to HUD on FHA’s new early payment forbearance policy.

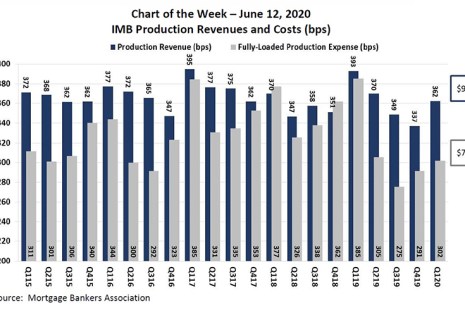

MBA Chart of the Week: IMB Production Revenues & Costs

MBA last week released its Quarterly Performance Report for the first quarter. The total sample of 336 independent mortgage banks and mortgage subsidiaries of chartered banks earned an average pre-tax production profit of 61 basis points (or $1,600) on each loan they originated – a solid showing particularly for a first quarter.