Commercial/multifamily mortgage debt outstanding rose by $61.0 billion (1.7 percent) in the first quarter, according to the Mortgage Bankers Association’s quarterly Commercial/Multifamily Mortgage Debt Outstanding report.

Category: News and Trends

MBA Recognizes Premier, Select Members

MBA is proud to recognize its Premier and Select Associate Members and to thank them for their continued support of MBA and the real estate finance industry.

Arend de Jong: Got RODA? Turn Your Customers into an Income-Generating Asset

For years, you took great care to build your list. Clients, and also prospects that didn’t quite become clients yet, but whom you fully intend to make into a client one day. You actually spent quite a bit of money getting the list together. To keep your prized possession whole, you spend quite a bit of time maintaining it. But… have you cracked the code on how to make this pay off for you? Sure: you love returning clients, but are you capitalizing on your list structurally?

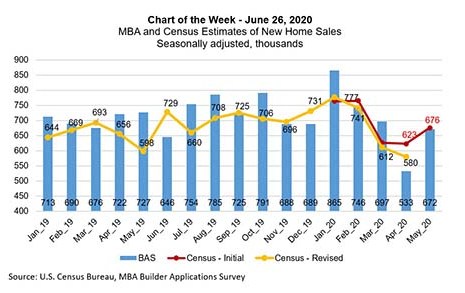

MBA Chart of the Week: MBA, Census Estimates of New Home Sales

This week’s chart shows how the U.S. Census Bureau’s new home sales series has compared to our Builder Applications Survey data from 2019 through May 2020. The BAS has been a reliable leading indicator of Census’ new home sales data.

MBA Education Path to Diversity Scholar Profile: Sharon Wortman

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

The Week Ahead

Good morning! Welcome to a short but busy week ahead of the Independence Day holiday.

MBA Advocacy Update

Last week, the Consumer Financial Protection Bureau released two Notices of Proposed Rulemaking revising Regulation Z’s QM provisions in response to the scheduled expiration of the GSE Patch on January 10, 2021. The CFPB also issued an Interim Final Rule that will facilitate servicers’ ability to offer streamlined deferral options to borrowers as they exit COVID-19-related forbearance.

Technology Talk: Q&A with SS&C’s Bob Wright, CMB, CCMS

MBA NewsLink interviewed Bob Wright, CMB, CCMS,about SS&C Technologies’ work-from-home experience and his experience with Coronavirus.

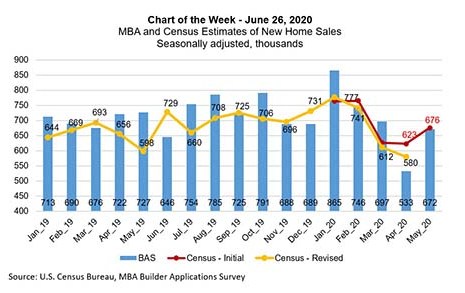

MBA Chart of the Week: MBA, Census Estimates of New Home Sales

This week’s chart shows how the U.S. Census Bureau’s new home sales series has compared to our Builder Applications Survey data from 2019 through May 2020. The BAS has been a reliable leading indicator of Census’ new home sales data.

MBA Education Path to Diversity Scholar Profile: Sharon Wortman

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)