(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Category: News and Trends

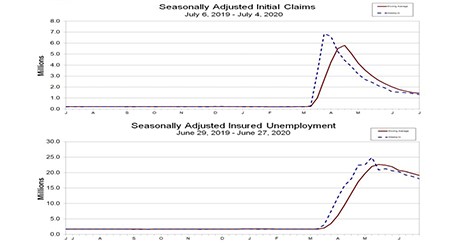

Unemployment Claims Top 1M for 16th Consecutive Week

The good news: initial claims fell for the 14th consecutive week, the Labor Department said yesterday. The bad news: despite the decrease, initial claims topped one million for the 14th consecutive week and look as if they will continue to do so for several more weeks.

Dealmaker: Renaissance Harborplace Hotel Trades for $80M

Hodges Ward Elliott, Atlanta, represented Sunstone Hotel Investors when it sold the 622-room Renaissance Harborplace hotel in Baltimore for $80 million.

Rent Cuts Disappearing in Many Markets As Apartment Demand Rebounds

When COVID-19 hit in mid-March, apartment operators quickly cut rents as demand evaporated. Today leasing volumes are “surging” and rent cuts are quickly disappearing in many big U.S. metros, reported RealPage, Richardson, Texas.

Quote

“A normal level of claims in an economy this size is likely somewhere between 300,000 and 350,000—or about one million below the current level. In short, we still have quite a bit a way to go to get back to ‘normal.’”

–Tim Quinlan, Senior Economist with Wells Fargo Securities, Charlotte, N.C.

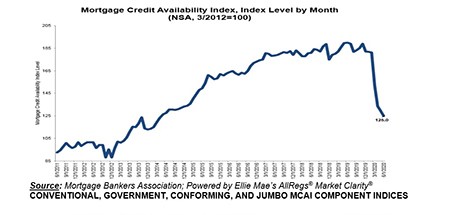

Mortgage Credit Availability Falls Again, Remains at 6-Year Low

Mortgage credit availability fell in June for the fourth consecutive month, remaining at a six-year low, the Mortgage Bankers Association reported this morning.

Faith Schwartz: New Era Borne of Pandemic to Upend Mortgage Costs

As longtime industry participants, we at Housing Finance Strategies contend that the pandemic has created a revolutionary opportunity that we must seize and leverage so that the mortgage business can emerge with higher quality prospective products funded through a drastically reduced cost structure.

Andrew Foster: Preferred Equity Plan for Commercial Real Estate Comes to Washington

This week in Washington, ongoing COVID-19 relief discussions have reached the commercial real estate borrowing community and their financiers in earnest.

MISMO Certifies First Two Remote Online Notary Products

MISMO®, the mortgage industry standards organization, today announced eNotaryLog and Notarize are the first two companies to complete MISMO’s new Remote Online Notarization certification program. RON certification provides assurance that products fulfill the requirements of the MISMO Remote Online Notary Standards.

Michael Steer & Erin Harris: Accelerated Digital Mortgage Tech Strategies Must Also Include Sound Vendor Management

Adherence to vendor management best practices needs to remain top of mind for lenders even when accelerating their digital mortgage tech selection and deployment process. Compliance with regulatory requirements and proper risk mitigation are not steps to be overlooked.