Builder confidence in the market for newly built single-family homes jumped 14 points to 72 in July, the National Association of Home Builders reported yesterday, calling it a “strong signal” that the housing market is ready to lead a post-COVID economic recovery.

Category: News and Trends

Dealmaker: Grandbridge Real Estate Capital Secures $50M

Grandbridge Real Estate Capital, Charlotte, N.C., secured $50.2 million for multifamily and retail properties in three states.

MISMO Launches Initiative to Facilitate Servicing Transfers

MISMO®, the mortgage industry’s standards organization, is seeking industry participants to collaborate on a new initiative to facilitate servicing transfers.

Quote

“Now is the time to scrutinize existing programs to expand those that work and fix or discard those that do not. Now is the time to work together to develop new approaches that leverage technology and creativity to close the minority homeownership and wealth gaps.”

–MBA President and CEO Robert Broeksmit, CMB, in a letter to HUD Secretary Ben Carson asking HUD to delay proposed changes to its disparate impact rule.

Mortgage Vendor News & Views with Scott Roller–July 17, 2020

In this ongoing article series, we report on mortgage and credit union vendor marketplace events and trends, and we then share our viewpoints. Today we highlight three very unique tech vendors that help in attracting and retaining borrowers, while improving your customer care model via a variety of newer entrants in our service provider market.

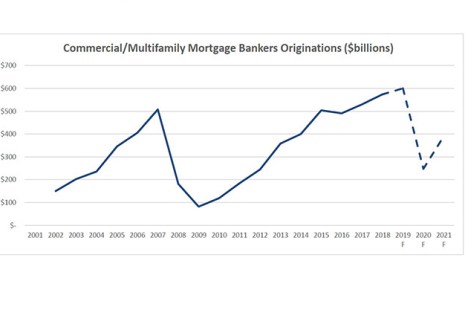

COVID-19 Pandemic to Cause Commercial/Multifamily Lending Pullback in 2020

Commercial and multifamily mortgage bankers are expected to close $248 billion in loans backed by income-producing properties this year, a 59 percent decline from 2019’s record volume of $601 billion, a new Mortgage Bankers Association forecast said.

MBA Education Path to Diversity Scholar Profile: Lakendra Turner

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Fannie Mae: Prepare to Go Digital with eMortgage

The eMortgage Readiness Checklist outlines key steps toward adopting a digital mortgage process and will prepare you for selling and servicing eMortgages with Fannie Mae. Use it to assess readiness and track your progress.

Rick Triola: How to Avoid Leaving an Empty Seat at the Closing Table

two years ago, mortgage industry advisory firm STRATMOR Group published data illuminating just how important it is for loan officers to attend their closings. We live in a very different world than we did two years ago, and while the nature of closings may have changed in 2020, the impact of the closing on the overall borrower experience has not.

FHA Proposes Streamlined Single-Family Servicing Policies; CFPB Touts Benefits of Credit Builder Loans

The Federal Housing Administration this week published proposed revisions to its Single-Family servicing policies, designed to remove “unnecessary barriers” for homeowners seeking mortgage payment relief, achieve operational consistency with industry standard best practices and reduce burdens incurred by the industry when servicing an FHA-insured mortgage portfolio.