Real estate, long the favorite way to invest and for many a path to wealth, fell to second place this year as more Americans take a gamble on the stock market, according to a new report from Bankrate.com, New York.

Category: News and Trends

Dealmaker: George Smith Partners Secures $69M in Bridge Financing

George Smith Partners, Los Angeles, secured $68.5 million in bridge financing for mixed-use properties in Colorado and California.

MBA Advocacy Update

Last Monday, Senate Republicans released the HEALS Act – an additional COVID-19 relief package that includes direct stimulus payments and updates to the SBA’s Payment Protection Program. On Wednesday, the Federal Housing Finance Agency announced temporary adjustments to the Duty to Serve program for 2020 and 2021. Also last week, the Senate confirmed Dana Wade to be the next FHA Commissioner by a 57-40 vote.

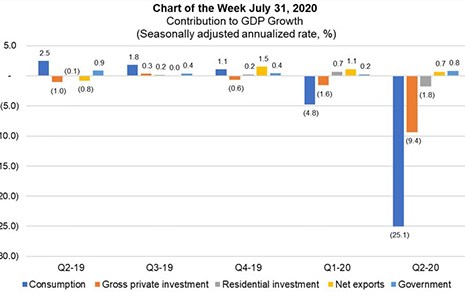

MBA Chart of the Week: Contribution to GDP Growth

This week’s MBA Chart of the Week drills down on the U.S. Bureau of Economic Analysis’ advance estimate of real gross domestic product for the second quarter, which was released July 30.

MBA Premier Member Profile: Asurity

The Asurity ecosystem combines a suite of tech-enabled mortgage solutions

The Week Ahead

Good morning! And congratulations—you’ve made it through another month of 2020! Only five more months to go! Just don’t open any unsolicited seed packets…

People in the News Aug. 3, 2020

Freddie Mac, McLean, Va., named Ling Xu vice president of Multifamily Investments & Portfolio Management, adding market risk and capital strategy to her current responsibilities, which include management of the company’s multifamily portfolio strategy, hedging and balance sheet management.

Sponsored Content: Credit Union Enriches its Member Experience with BeSmartee POS Innovation

Orange County’s Credit Union sees mortgage applications soar after implementing BeSmartee’s custom SmartForm solution.

Quote

“As the crisis deepened, it seemed like a game of whack-a mole; every day there was something else that might prevent real estate finance from continuing. From appraisers being leery of setting foot into strangers’ homes and people not wanting strangers in their homes to county courthouses closing to an inability to verify employment, all the very basic parts of lending.”

–MBA President & CEO Robert Broeksmit, CMB, discussing the state of the real estate finance industry during a recent ‘Walker Webcast.’

Fannie Mae: Helpful eMortgage Resources

With the recent shift many people have experienced to remote work, digital closing options are top of mind for lenders. Fannie Mae has a variety of eMortgage resources to help you.