Brookstone Management, Howell, N.J., a national provider of mortgage field services, announced JK Huey, CMB, AMP, joined its Advisory Board and will serve as Corporate Ambassador.

Category: News and Trends

Brian Zitin: Appraisals—The Final Frontier in Digital Mortgages

With the average time to close a mortgage transaction still 40+ days, the experience of a “one-tap” digital mortgage seems distant to most onlookers. In reality, however, the important measure of efficiency is how long a borrower actually spends in the mortgage factory line—in other words, how long it takes to get approved and complete all of the necessary requirements and paperwork before closing.

Quote

“COVID-19 continues to have a profound impact on our economy, and while no industry is immune, we have been buoyed by the resiliency of commercial real estate, including steady rent collections and continued deal activity.”

–Ernie Katai, Executive Vice President and Head of Production with Berkadia, New York.

CRE Professionals Envision COVID-19 Recovery by 2021

Initial concerns about the COVID-19 pandemic’s impact on multifamily real estate have not been realized, said Berkadia, New York.

Record Low Rates Drive Mortgage Applications Increase in MBA Weekly Survey

Mortgage applications rose for the fourth time in five weeks as key interest rates once again fell to record lows, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending August 7.

Brian Lynch: With Low Rates, Increasing Loan Volumes, Mortgage Companies Need More Access to Financial Reporting and Management Tools

As companies loan volumes continue to rise, so does the need for in-depth financial management and reporting tools that can help mortgage companies track and manage the month-over-month changes.

Dealmaker: Bellwether Enterprise Closes $21M Affordable Housing Deal

Bellwether Enterprise Real Estate Capital LLC, Cleveland, closed a $20.5 million loan to rehabilitate and preserve affordability of nine multifamily properties in West Town and Humboldt Park in Chicago.

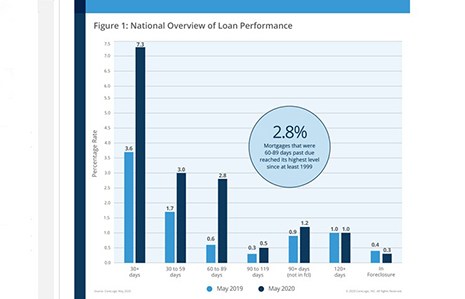

CoreLogic: ‘Clouds on The Horizon’ for Many U.S. Homeowners as Delinquency Rates Climb

Ahead of next week’s 2nd Quarter National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said early-stage and adverse mortgage delinquency rates increased for the second consecutive month, with all 50 states and more than 75% of U.S. metro areas seeing increases in overall delinquency rates.

MBA Asks CFPB to Extend GSE ‘Patch’ Sunset

The Mortgage Bankers Association, in a comment letter yesterday to the Consumer Financial Protection Bureau, asked the Bureau to extend the temporary GSE Qualified Mortgage loan definition, also known as the GSE “Patch,” for an additional six months following the effective date for the revised general QM parameters.

MBA, Trade Groups Ask CFPB to Extend Comment Period on ECOA Request for Information

The Mortgage Bankers Association and nearly a dozen industry trade organizations on Aug. 10 asked the Consumer Financial Protection Bureau to extend the comment period on its Request for Information on expanding access to credit through Regulation B, which implements the Equal Credit Opportunity Act.