The Federal Housing Finance Agency this afternoon said Fannie Mae and Freddie Mac would delay implementation of a controversial Adverse Market Refinance Fee by two months, to Dec. 1.

Category: News and Trends

Quote

“We welcome today’s announcement from the FHFA amending the recently announced Adverse Market Refinance Fee from Fannie Mae and Freddie Mac. Extending the effective date will permit lenders to close refinance loans that are in their pipelines and honor the rate lock commitments they made to their borrowers, ensuring that economic relief in the form of record low interest rates will continue to flow to consumers.”

–MBA President and CEO Robert Broeksmit, CMB.

FHFA Delays Refi Fee Implementation to Dec. 1

The Federal Housing Finance Agency this afternoon said Fannie Mae and Freddie Mac would delay implementation of a controversial Adverse Market Refinance Fee by two months, to Dec. 1.

State Regulators Seek Industry Input on MLO Licensing Test

State financial service regulators launched a survey of licensed mortgage loan originators yesterday to gather information on various job functions as part of a process to validate the nationwide licensing exam.

COVID is Accelerating CRE Trends

Kroll Bond Rating Agency, New York, said the COVID-19 pandemic accelerated many commercial real estate trends already in progress.

Consumer Confidence Falls to 6-Year Low

The Conference Board, New York, reported its Consumer Confidence Index fell for the second straight month in August to a six-year low.

July New Home Sales Hit 13-Year High

Sales of new single-family houses in July posted another strong double-digit gain, jumping to their strongest pace since 2006, HUD and the Census Bureau reported yesterday.

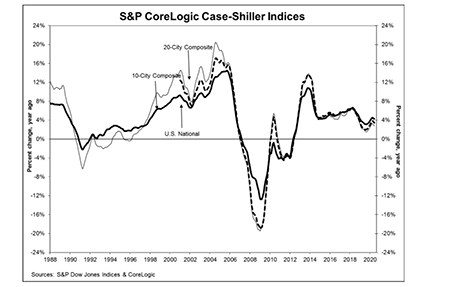

Strong Fundamentals Keep Home Prices on Steady Rise

S&P Dow Jones Indices, New York, said S&P CoreLogic Case-Shiller Indices showed U.S. home prices rose by 4.3 percent annually in June, unchanged from May.

Dealmaker: Tauro Capital Advisors Secures $50M for Triple-Net-Lease Developers

Tauro Capital Advisors, Los Angeles, secured $50 million in revolving debt facilities for single-tenant triple-net-lease property developers.

Mortgage Applications Down Again in MBA Weekly Survey

Mortgage applications fell for the second straight week amid little movement in interest rates, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending August 21.