Berkadia arranged the $30.6 million sale and financing for Turtle Creek Apartment Homes, a 232-unit garden-style apartment community 15 miles north of downtown Tampa, Fla.

Category: News and Trends

MBA Offers Recommendations to FHFA on New GSE Capital Framework

The Mortgage Bankers Association asked the Federal Housing Finance Agency to restructure the capital framework for Fannie Mae and Freddie Mac, moving from past business models to a market utility approach that enables them to meet all of their obligations.

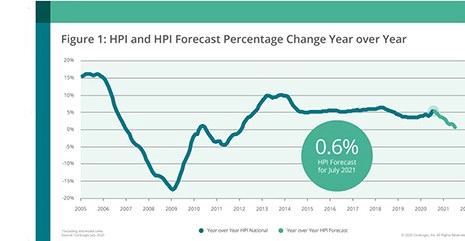

‘Strong and Resilient:’ CoreLogic Home Price Index at 2-Year High

CoreLogic, Irvine, Calif., said its U.S. Home Price Index jumped to a 5.5% year-over-year increase in July, its highest level since 2018. Month over month, the Index rose by 1.2%.

Life Insurance Commercial Mortgage Return Index Surges

Commercial mortgage investments held by life insurance companies posted a 4.58 percent total return in the second quarter, a major reversal from the first quarter’s negative 1 percent return, said Trepp LLC, New York.

Quote

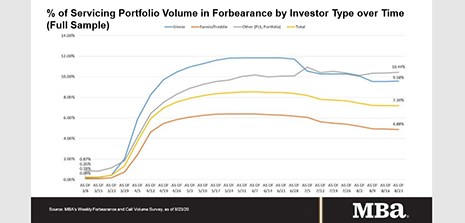

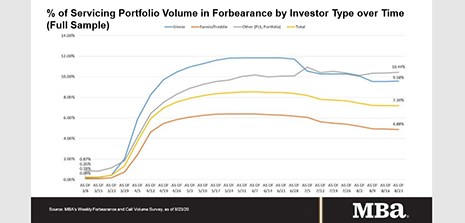

“The pace of new forbearance requests has been relatively flat across investor types, but for those with GSE loans, the rate of exits from forbearance regularly exceeds the rate of new requests. The exception in these trends are borrowers with Ginnie Mae loans. The loss of enhanced unemployment insurance benefits, coupled with a consistently high rate of layoffs and uncertainty about the job market, are having a disproportionate impact on FHA and VA borrowers.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

MBA: Share of Mortgage Loans in Forbearance Flat at 7.20%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the percentage of loans in forbearance stayed flat for the second straight week, holding at 7.20% as of Aug. 23.

MBA: Share of Mortgage Loans in Forbearance Flat at 7.20%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the percentage of loans in forbearance stayed flat for the second straight week, holding at 7.20% as of Aug. 23.

MBA Education Path to Diversity Scholar Profile: Ashley Duffy

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Quote

“The pace of new forbearance requests has been relatively flat across investor types, but for those with GSE loans, the rate of exits from forbearance regularly exceeds the rate of new requests. The exception in these trends are borrowers with Ginnie Mae loans. The loss of enhanced unemployment insurance benefits, coupled with a consistently high rate of layoffs and uncertainty about the job market, are having a disproportionate impact on FHA and VA borrowers.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

Bridge Over Troubled Water: Debt Funds and Mortgage REITs Come of Age During COVID-19

It can be challenging to raise capital for public companies involved in commercial real estate lending against a backdrop of falling stock prices. This has led to an inward focus on activities such as asset management and building liquidity for public mortgage REITs, making these market participants less active for new loan originations.