(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Category: News and Trends

Former Ambassador Andrew Young Keynotes MBA Annual20

Former Ambassador to the United Nations Andrew Young keynotes an important General Session at MBA Annual20, which runs online Oct. 19-21.

Quote

“The share of loans in forbearance has dropped to its lowest level in five months, driven by a consistent decline in the GSE share in forbearance. However, not only the did the share of Ginnie Mae loans in forbearance increase, new requests for forbearance for these loans have increased for two consecutive weeks. While housing market data continue to show a quite strong recovery, the job market recovery appears to have slowed, and we are seeing the impact of this slowdown on FHA and VA borrowers in the Ginnie Mae portfolio.”

–MBA Chief Economist Mike Fratantoni.

MBA: Loans in Forbearance Fall to Lowest Level in 5 Months

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall to 5-Month Low

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

Quote

“The share of loans in forbearance has dropped to its lowest level in five months, driven by a consistent decline in the GSE share in forbearance. However, not only the did the share of Ginnie Mae loans in forbearance increase, new requests for forbearance for these loans have increased for two consecutive weeks. While housing market data continue to show a quite strong recovery, the job market recovery appears to have slowed, and we are seeing the impact of this slowdown on FHA and VA borrowers in the Ginnie Mae portfolio.”

–MBA Chief Economist Mike Fratantoni.

MBA Advocacy Update Sept. 22, 2020

MBA and several trade organizations sent a letter to Congress asking them to consider a longer-term solution to the National Flood Insurance Program, which is set to expire at the end of the month. Also last week, the Supreme Court set oral arguments for December 9 in Collins v. Mnuchin, the case that will determine the constitutionality of the FHFA’s independent director structure.

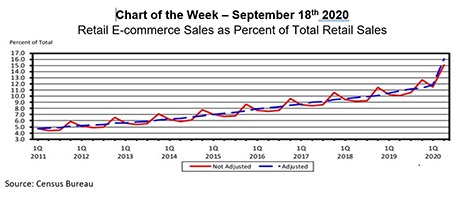

MBA Chart of the Week: Retail E-Commerce/Retail Sales

Even before the onset of the pandemic, retail properties were under the microscope. Practitioners spoke about the United States being “over-retailed” compared to other countries, about a shift to experiential retail with a focus on services rather than goods, and about how the rise in e-commerce is a challenge to bricks-and-mortar.

Mark Dangelo: Beyond Digital Transformation Part 2—Challenges of Digital Iterations

While advice and directions concentrate on the “next normal” inflicted by Covid-19, the underlying challenges facing financial services and banking organizations have been building long before its arrival. If banking and mortgage leadership are to adjust to an altered consumer and investment future, they must quickly determine how to build core competencies with digital leveraging—or risk becoming a statistic.

RIHA Study: COVID-19’s Impact on Jobs, Ability to Make Housing, Student Debt Payments

During the first three months of the COVID-19 pandemic, nearly 11 million households fell behind on their rent or mortgage payments and 30 million individuals missed at least one student loan payment, according to new research released today by the Mortgage Bankers Association’s Research Institute for Housing America.