MBA holds its first-ever virtual Annual Convention & Expo. Taking place October 19-21 via MBA LIVE, attendees can connect whenever they want, from wherever they want. The early registration deadline has been extended to Wednesday, Oct. 7–register early and save up to $350.

Category: News and Trends

Life Insurers Brace for Higher Commercial Mortgage Losses

Fitch Ratings, New York, said life insurance companies could see higher losses on commercial mortgage loans than they saw during the Great Recession.

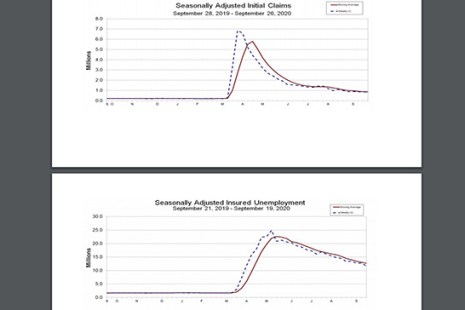

Little Movement in Unemployment Claims for 2nd Straight Week

Initial claims for unemployment insurance fell just slightly for the second straight week, suggesting recovery from the coronavirus-induced economic slowdown will remain slow and gradual.

Dealmaker: Gantry Secures $13M for Two Industrial Assets

Gantry, San Francisco, secured $12.75 million in financing for industrial properties in California and Washington.

MBA Offers Recommendations to CFPB ‘Seasoned QM’ Proposal

The Mortgage Bankers Association, in an Oct. 1 letter to the Consumer Financial Protection Bureau, offered several recommendations in response to the Bureau’s request for comment on its proposed rule creating a new category of “seasoned” Qualified Mortgage loans.

Quote

“Both of these propositions are not only important to our constituents in California, but they should be important to every commercial real estate lender nationwide.”

–MBA Senior Vice President of Commercial Real Estate Mike Flood, on two California ballot propositions addressing taxes and rent controls.

MBA, California MBA Oppose California Props. 15 and 21

On Election Day, Californians will vote for or against two ballot initiatives strongly opposed by the Mortgage Bankers Association, California MBA and other industry partners.

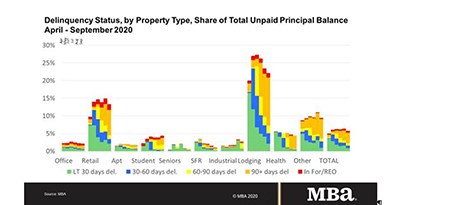

MBA: September Commercial, Multifamily Mortgage Delinquencies Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey reported.

Sponsored Content from Pavaso: Data Privacy and Working with eClosing Service Providers

Overlooking this factor when choosing an eClosing technology service provider could cost you.

Sponsored Content from Monster Lead Group: Creating a Sustainable Mortgage Sales Model

Expert advice on maximizing current capacity, a winning market strategy, preparing your team for post-2020 success, and more.