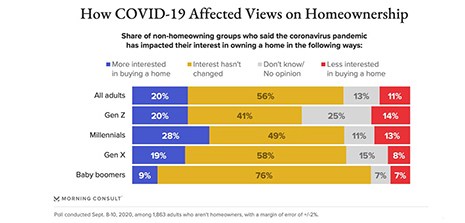

Here are summaries of the latest housing finance reports, from Black Knight; Redfin; Zillow; and Morning Consult.

Category: News and Trends

Along Came COVID: Emerging Tech Trends in Commercial Real Estate Finance

Emerging technologies and start-up firms proliferated in commercial real estate over the last several years. With the conventional wisdom being that while the single-family real estate finance industry has embraced new technologies and innovation, CRE was a laggard and therein lies a massive opportunity.

Dealmaker: Newmark Knight Frank Closes $330M Office Sale

Newmark Knight Frank, New York, completed the $330 million sale of Reservoir Woods East, an office campus in Waltham, Mass.

Tom Millon, CMB, and Tony Pistilli: Valuations and the Pandemic–The ‘New Normal’ for Appraisal

Temporary, alternative inspections methods help to demonstrate the reliability and benefits of bifurcation and may very well assist in the evolution of home appraisals.

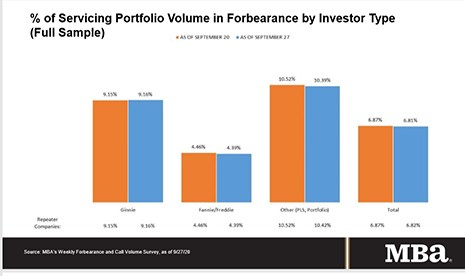

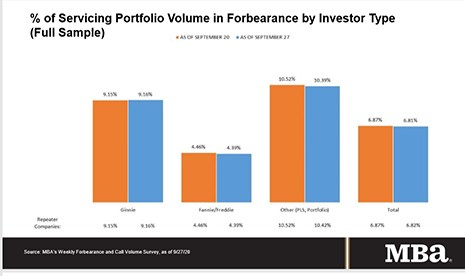

MBA: Share of Loans in Forbearance Falls to 6.81%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.

Quote

“The significant churn in the labor market now, more than six months into the pandemic, is still causing financial distress for millions of homeowners. As a result, more than 70 percent of loans in forbearance are now in an extension.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

Quote

“The significant churn in the labor market now, more than six months into the pandemic, is still causing financial distress for millions of homeowners. As a result, more than 70 percent of loans in forbearance are now in an extension.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

MBA: Share of Loans in Forbearance Falls to 6.81%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.

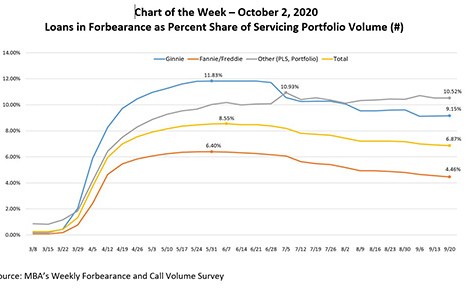

MBA Chart of the Week: Loans in Forbearance as Share of Servicing Portfolio Volume

According to the latest edition of MBA’s Weekly Forbearance and Call Volume Survey, released last week, the share of loans in forbearance dropped to 6.87 percent of servicers’ portfolio volume as of September 20. The share was the lowest point since mid-April, and 168 basis points below a peak of 8.55 percent during the week ending June 7.

MBA Advocacy Update Oct. 6, 2020

On Wednesday, President Trump and Congress agreed to a Continuing Resolution that funds the federal government through mid-December and reauthorizes the National Flood Insurance Program through September 30, 2021.