Housing Market Roundup, Oct. 6, 2020

Here are summaries of the latest housing finance reports, from Black Knight; Redfin; Zillow; and Morning Consult.

Black Knight: Delinquencies Could Remain Elevated through 2022

Black Knight, Jacksonville, Fla., said trend lines of COVID-19’s impact on mortgage performance have begun to diverge and indicate a longer recovery period ahead. Three-month average rates since mortgage delinquencies peaked in late May suggest delinquencies could remain above pre-pandemic levels for another 19 months.

The company’s latest Mortgage Monitor Report said the same trend would result in more than one million excess delinquencies in March 2021, when the first wave of forbearances reach their 12-month expiration period.

Black Knight said of the 6.1 million homeowners who have been in COVID-19-related forbearance plans, 41% (2.4 million) have since exited, with the vast majority of those borrowers currently performing; of those who remain past due, 267,000 are in active loss mitigation with their lenders. Just 54,000 loans are past due and not in active loss mitigation, and 70% of these were already past due in February before the pandemic began to impact mortgage performance

Black Knight Data & Analytics President Ben Graboske said while this divergence suggests a prolonged recovery period may lay ahead, there are several mitigating factors which together could help lessen the size of a follow-on wave of foreclosures. “While this may seem to paint a bleak picture for the future, multiple mitigating factors could help to reduce any resulting foreclosure wave,” he said. “While recovery has been slow and incremental, the bulk of homeowners who have come out of forbearance are currently performing on their mortgages.”

Even when applying distressed valuations to the more than 2.5 million homes either 90 or more days past due or in active foreclosure, the report found that tappable equity hit another record high in the second quarter as home prices continued to rise across much of the country. In total, nearly 45 million homeowners have tappable equity in their homes, the largest volume ever. The average homeowner now has nearly $125,000 in tappable equity; an increase of more than $3,200 from last year – also a record.

Redfin: Condo Prices Climb 5.4% in August, Lagging 11.9% Growth for Single-Family Homes

Redfin, Seattle, reported condo sale prices in the U.S. increased 5.4% year over year to a median of $266,000 in August, trailing growth in single-family home prices, which surged 11.9% to $343,000. That’s the largest price-growth gap between the two property types since 2014.

The report said one in five condos (21.9%) sold for above the price at which it was listed, up slightly from 19.2% in a year ago. That compares with one of every three single-family homes (33.6%), up from 24.3% a year earlier and the highest share on record.

“Home prices have been growing across all property types, as record-low mortgage rates have suddenly equipped Americans with more buying power. But condos have experienced relatively modest price growth because the coronavirus pandemic has motivated many homebuyers to instead bid on single-family homes, which typically offer more space and privacy,” said Redfin lead economist Taylor Marr. “But if prices of single-family homes continue to surge to unsustainable levels, condos may make a comeback, as they could become the only type of home that buyers in some areas can afford while also avoiding intense bidding wars.”

The report said condo sales climbed 11.8% in August on a seasonally adjusted basis, outpacing the 10.8% increase in sales of single-family homes and surpassing the pre-coronavirus (February) growth rate for the first time. The typical condo was on the market for 36 days before going under contract in August, four days faster than a year earlier. Still, that trails the pace of the typical single-family home, which spent just 30 days on the market before going under contract—nine days faster than the prior year.

The report can be accessed at https://www.redfin.com/blog/condo-real-estate-prices-increase-august/.

Zillow: Sellers Market Still Hot, but Fall Cooling Approaches

Zillow, Seattle, said sellers still hold the reins of the U.S. housing market as prices reach record year-over-year gains and low inventory further erodes, according to the Zillow Weekly Market Report. However, tapering pending sales and minimal recent growth in list prices point to an overdue seasonal market slowdown that may finally be coming.

The report said newly pending listings rose by 22.2% year over year, but fell by4.6% month over month and 1.5% week over week. Though the pandemic pushed the buying season back and demand is still high, buyers’ scramble for houses seems to be calming somewhat.

As has been the case throughout much of August and September, Zillow reported houses typically stayed on the market for 13 days across the U.S. Listings’ median time on the market has grown shorter compared to last year since mid-May, and they now typically go pending 15 days sooner than during the same week in 2019.

Inventory remains an issue. The long contraction in for-sale inventory continued for the 18th straight week, now standing at 35% below 2019 levels. This represents the largest year-over-year drop in total inventory in Zillow’s recently launched weekly data series going back through 2019, and is consistent with a larger drop than any recorded in Zillow’s monthly inventory data back to 2013. Inventory is down 3.2% month over month.

Morning Consult: Pandemic Pushing Some Millennials to Look into Homeownership

Morning Consult, Washington, D.C., said with the coronavirus pandemic continuing to make city-dwelling less of a necessity for urban professionals facing the prospect of continued remote work, some millennials are looking to bid farewell to rental life in favor of more space and stability in their living arrangements.

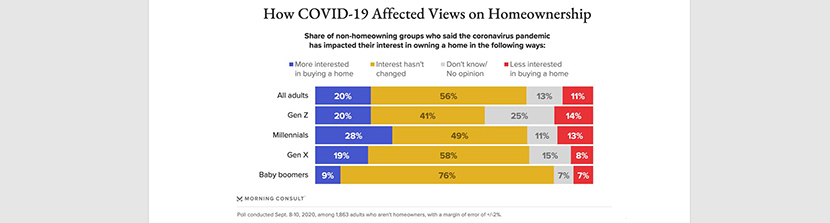

The Morning Consult survey said 28% of millennials who don’t live in a home they own said they are more interested in buying one because of the coronavirus pandemic. 20% of all adults, 20% of Gen Zers and 19% of Gen Xers who don’t live in a home they own said the same. Baby boomers who don’t live in a home they own were the most likely generation to say the pandemic hasn’t affected their interest in homeownership, at 76%.

“The question of millennials and homeownership addresses something more fundamental about the generation,” the survey said. “While older groups are more likely to have settled into their mortgages and financial habits, the coronavirus could permanently shape the future financial priorities of millennials, currently the largest working cohort in the United States.”