Freddie Mac, McLean, Va., reported that overall rental payment performance has remained strong in the face of the pandemic-related economic downturn.

Category: News and Trends

Commercial/Multifamily Borrowing Falls 47 Percent in Third Quarter

Commercial and multifamily mortgage loan originations were 47 percent lower in the third quarter compared to a year ago, and increased 12 percent from the second quarter of 2020, the Mortgage Bankers Association reported.

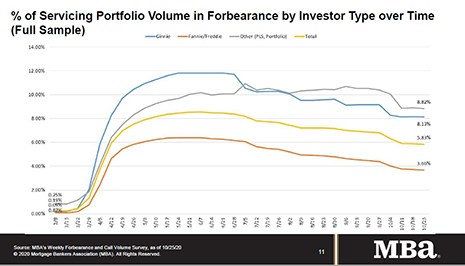

Share of Mortgage Loans in Forbearance Decreases to 5.83%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey revealed the total number of loans now in forbearance decreased by 7 basis points from 5.90% of servicers’ portfolio volume in the prior week to 5.83% as of October 25, 2020.

Quote

“With more borrowers exiting forbearance in the prior week, the share of loans in forbearance declined across all loan types. Almost half of forbearance exits to date have been from borrowers who remained current while in forbearance, or who were reinstated by paying back past-due amounts.”

–MBA Senior Vice President and Chief Economist Mike Fratantoni.

Quote

“With more borrowers exiting forbearance in the prior week, the share of loans in forbearance declined across all loan types. Almost half of forbearance exits to date have been from borrowers who remained current while in forbearance, or who were reinstated by paying back past-due amounts.”

— MBA Senior Vice President and Chief Economist Mike Fratantoni.

Tech Industry Drives Office Leasing Despite Pandemic

Tech industry job loss has been minimal during the pandemic, and the tech sector is still driving U.S. office-leasing activity, reported CBRE, Los Angeles.

Dealmaker: Kennedy Wilson Acquires Multifamily Portfolio for $198M

Kennedy Wilson, Beverly Hills, Calif., acquired 880 units across three multifamily properties in a $198 million off-market transaction.

MBA Advocacy Update Nov. 3, 2020

On Wednesday, HUD extended FHA’s appraisal and reverification of employment flexibilities through December 31. On Tuesday, MBA submitted comments in response to the proposed interagency flood insurance Q&A jointly issued by the OCC, the Federal Reserve, FDIC, NCUA and FCA. Also on Tuesday, MBA issued a call to action to MAA members in Pennsylvania urging Gov. Tom Wolf to approve legislation (HB 2370) that would permanently enable the use of RON in the state.

Quote

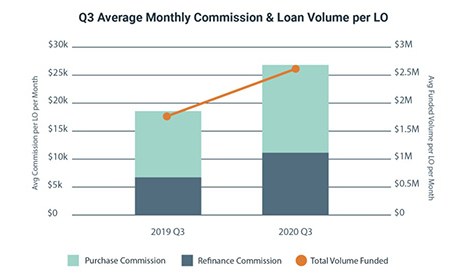

“Increased loan volume continues to deliver big paydays for loan originators as well as for loan processors, many of whom earn per-loan unit bonuses. The refi boom won’t continue indefinitely, though, and we’re already seeing some softening in refi volume even as consumer appetite for purchase loans sharpened in Q3.”

–Lori Brewer, Founder & CEO of LBA Ware, Macon, Ga.

LBA Ware: Heavy Loan Volumes Keeps LO Compensation Elevated

LBA Ware, Macon, Ga., releases its third quarter Mortgage Loan Originator Compensation Reports, showing commissions earned by LOs increased by 50% from a year ago, because the average LO funded 51% more volume in the third quarter ($2.6 million per month) than a year ago ($1.7 million per month).