Lenders face considerable challenges managing their in-house panels in the current mortgage environment. AMCs offer solutions.

Category: News and Trends

MISMO Seeks Comment on New API Toolkit

MISMO, the mortgage industry’s standards organization, released its new MISMO API (application programming interface) Toolkit yesterday for a 60-day member comment period.

Quote

“Mortgage rates continue to hover at record lows this fall. The drop in rates spurred an uptick in demand for refinances. Activity increased over 6 percent, with borrowers notably seeking conventional and government loans.” — MBA Associate Vice President of Economic and Industry Forecasting Joel Kan.

For Many, Despite Low Mortgage Rates, Down Payments Out of Reach

Even though mortgage affordability has improved since 2018 because of ultra-low mortgage rates, home values have grown at nearly twice the rate of incomes over the past six years, said Zillow, Seattle, making saving for a down payment—particularly for first time buyers—a challenge.

Sponsored Content from ServiceLink: Is It Time to Shift from Appraisal Self-Management to an AMC Model?

Lenders face considerable challenges managing their in-house panels in the current mortgage environment. AMCs offer solutions.

Multifamily Market Musings: Conversation with Fannie Mae’s Kim Betancourt, CRE

This year’s industry developments are dominated by the pandemic as well as associated social, political and economic impacts. Given this backdrop and the continued role of the GSEs in financing multifamily throughout market ups and downs, MBA NewsLink talked with Fannie Mae’s Kim Betancourt to get perspective on trends and what to watch as the multifamily market continues to evolve.

Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.8 percent for the week ending October 30, 2020 compared to one week earlier, the Mortgage Bankers Association reported this morning.

Commercial, Multifamily Borrowing Falls 47 Percent in Third Quarter

Commercial and multifamily mortgage loan originations were 47 percent lower in the third quarter compared to a year ago, and increased 12 percent from the second quarter of 2020, the Mortgage Bankers Association reported.

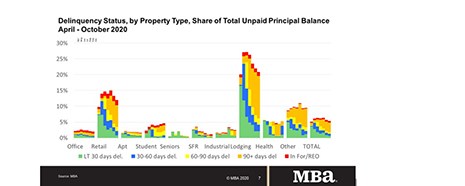

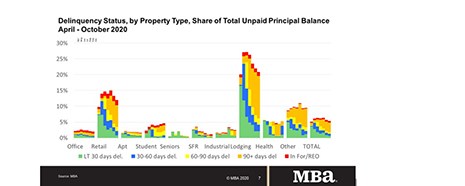

Commercial, Multifamily Mortgage Delinquencies Decline in October

Delinquency rates for mortgages backed by commercial and multifamily properties declined in October, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

Commercial, Multifamily Mortgage Delinquencies Decline in October

Delinquency rates for mortgages backed by commercial and multifamily properties declined in October, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.