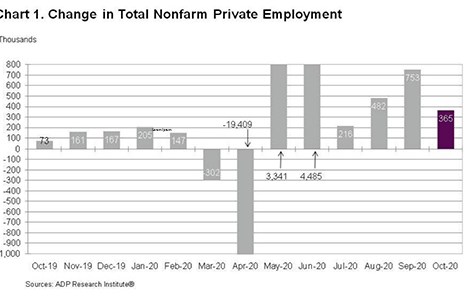

ADP, Roseland, N.J., said private-sector employment increased by 365,000 jobs from September to October.

Category: News and Trends

Millennials Jump on Low Rates

With interest rates nearing 3% for all loans, many millennials took advantage of the opportunity to refinance their mortgages in September, according to Ellie Mae, Pleasanton, Calif.

Smaller Metros—and Fewer Disasters—On Home Buyers’ Radar Screens

The coronavirus has caused a sea change in Americans’ attitudes toward home. With millions now working from home—many permanently—they are rethinking everything: how to repurpose rooms; how many cars they need to own; and especially, where they want to live, not where they need to live.

Black Knight: Rate Lock Data Suggests 2020 Originations Could Surpass $4 Trillion

Black Knight, Jacksonville, Fla., said its monthly Mortgage Monitor report shows rate lock activity continues to remain strong across the board, which could lead to new quarterly and yearly records for origination volume.

Industry Briefs Nov. 5, 2020

Top of Mind Networks, Atlanta, a provider in customer relationship management and marketing automation software for the mortgage lending industry, announced its integration with digital mortgage point-of-sale platform Floify, Boulder, Colo.

FOMC Headline HERE

FOMC lede sentence HERE

State Regulators Advise Licensees to Renew by Nov. 30

State regulators encourage individuals and businesses that provide mortgage, money transmission, debt collection and consumer financial services to renew their licenses in Nationwide Multistate Licensing System by November 30 to avoid processing delays.

Quote

“Climate change still doesn’t feel like an immediate threat to a lot of people, but as more folks come face to face with wildfires, hurricanes and floods, we’ll see an increase in the number of Americans who consider moving due to natural disasters. Climate change could also become a bigger factor in the homebuying process if insurance companies stop offering coverage in catastrophe-prone areas.”

–Daryl Fairweather, Chief Economist with Redfin, Seattle.

Multifamily Market Musings: Conversation with Fannie Mae’s Kim Betancourt

This year’s industry developments are dominated by the pandemic as well as associated social, political and economic impacts. Given this backdrop and the continued role of the GSEs in financing multifamily throughout market ups and downs, MBA NewsLink talked with Fannie Mae’s Kim Betancourt to get perspective on trends and what to watch as the multifamily market continues to evolve.

Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.8 percent for the week ending October 30, 2020 compared to one week earlier, the Mortgage Bankers Association reported this morning.