ATTOM Data Solutions, Irvine, Calif., reported 3.25 million mortgages secured by residential property originated in the third quarter, up 17 percent from the second quarter and 45 percent from a year ago, to the highest level in 13 years.

Category: News and Trends

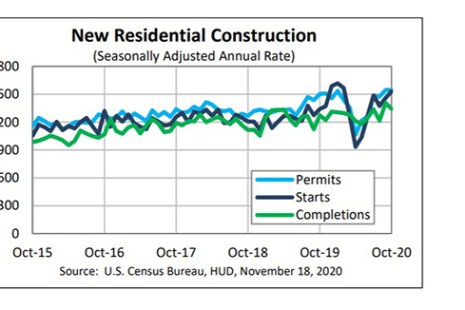

Housing Starts Continue to Ramp Up

The October housing starts report from HUD and the Census Bureau shows home builders continue to respond to consumers’ seemingly insatiable demand for new housing.

Generation Z Renters Moving On Up

More young adults are returning to the rental market reported Zillow, Seattle.

Dealmaker: Marcus & Millichap Brokers $33M in Retail Property Sales

Marcus & Millichap, Calabasas, Calif., sold six Walgreens drugstores and a Publix grocery store in six states.

Scott Roller: Mortgage Vendor News & Views (November)

This major trend continues – banks and lenders sticking to their core competencies and seeking strategic vendor partners for the non-core – via technology and outsourcing. The low rate ‘feeding frenzy’ will come to an abrupt end, we just don’t know when. Still yet, we are starting to see financial institutions give more focus to the bottom line – cost cutting. Engaging third-party vendors is often a first consideration, reducing fixed costs.

FHFA Sets $70 Billion 2021 GSE Multifamily Loan Purchase Caps

The Federal Housing Finance Agency on Tuesday announced 2021 multifamily loan purchase caps for Fannie Mae and Freddie Mac at $70 billion for each Enterprise, totaling $140 billion in support to the multifamily market.

Quote

“October is usually when home buying activity slows as the weather turns colder. However, this fall has been a different story, with delayed activity from the spring, and more households seeking larger homes with more indoor and outdoor space, driving demand.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

Mortgage Applications Dip in MBA Weekly Survey

Mortgage applications fell slightly even as key interest rates remained below 3 percent, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending November 13.

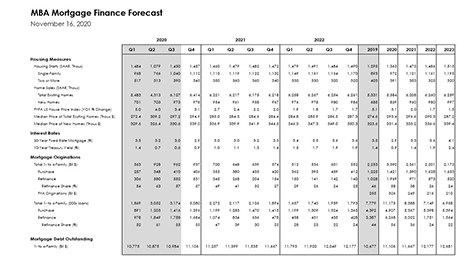

MBA: Upward Revisions to 2020, 2021 Mortgage Forecasts

The most volatile and unpredictable economy in a decade has produced the strongest housing market in more than a decade—and, according to the Mortgage Bankers Association, it could get even stronger.

MISMO Launches CRE Property Financials Workgroup; Issues Call for Participants

MISMO®, the mortgage industry standards organization, announced a call for participants for a new workgroup focused on a standards solution for commercial real estate.