RCLCO, Bethesda, Md., noted rental housing occupancy and rents have grown stronger in suburban markets than in urban areas recently.

Category: News and Trends

Dealmaker: Brokers $115M in Multifamily Sales

Transwestern Commercial Services, Houston, brokered three multifamily property sales totaling $115.2 million.

mPact 2020 Campaign Benefiting MBA Opens Doors Foundation

Participate in a virtual mPact event in December to benefit the MBA Opens Doors Foundation and help us keep families with critically ill or injured children in their homes. Join us and make a difference for a family in need.

Borden Hoskins Joins MBA as AVP of Legislative Affairs

The Mortgage Bankers Association announced Borden Hoskins joined the association as Associate Vice President of Legislative Affairs. He will be responsible for advocating MBA’s legislative and policy priorities on Capitol Hill, with a primary focus on Republican members of the House of Representatives.

Longtime Industry Executive, Advisor Gene Spencer Passes Away

Gene Spencer, who spent 28 years at Fannie Mae and 10 years with the Homeownership Preservation Foundation and who served in a number of advisory capacities with the Mortgage Bankers Association and other industry organizations, passed away on Nov. 30 in Gloucester Point, Va.

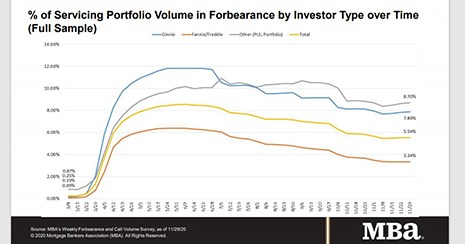

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

MBA Advocacy Update–Dec. 8, 2020

Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell testified last week before House and Senate committees providing an update on CARES Act oversight. In both hearings, Mnuchin addressed the future of the GSEs, and stressed that they should not be released from conservatorship until each has sufficient capital.

Quote

“Job market data for November showed an economic recovery that was slowing in response to the latest surge in COVID-19 cases. It is not surprising to see the rate of forbearance exits slow, as households that needed forbearance assistance in October may be in even greater need now.”

–MBA Chief Economist Mike Fratantoni.

People in the News Dec. 8, 2020

Cherry Creek Mortgage, Denver, appointed Rick Seehausen to president and COO of Cherry Creek Holdings, where he will oversee all company operations, including IT, human resources, legal, accounting, marketing and compliance divisions.

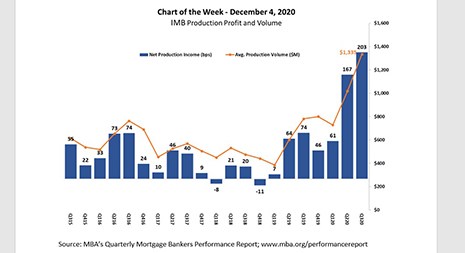

MBA Chart of the Week: IMB Production Profit and Volume

MBA released its latest Quarterly Performance Report for the third quarter last week. Independent mortgage banks and mortgage subsidiaries of chartered banks reported study-high average pre-tax production profits of 203 basis points ($5,535 on each loan originated) in the third quarter, up from 167 basis points ($4,548 per loan) in the second quarter.