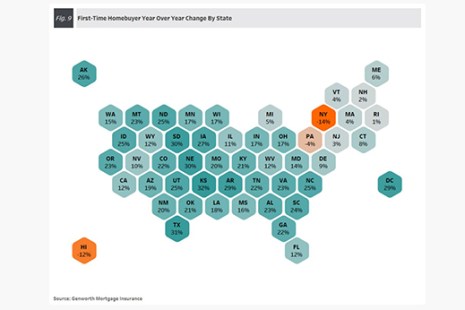

Historically low interest rates, change in home preferences, flexible work schedules and increased housing affordability triggered substantial rebound in first-time homebuyer market in the third quarter, said Genworth Mortgage Insurance, Richmond, Va.

Category: News and Trends

MBA Premier Member Profile: LBA Ware

Founded in 2008, LBA Ware™, Macon, Ga., is the leading provider of automated incentive compensation management and business intelligence software for mortgage lenders. Our suite of solutions helps mortgage lenders reach new heights with software that integrates data, incentivizes performance and inspires results.

Dealmaker: KeyBank Real Estate Capital Secures $82M for Healthcare, Multifamily

KeyBank Real Estate Capital, Cleveland, secured $81.6 million in financing for healthcare and apartment assets in New York and Arizona.

MBA Mortgage Action Alliance Reaches 70,000-Member Milestone

The Mortgage Bankers Association announced its grassroots advocacy arm, the Mortgage Action Alliance, reached a record-setting milestone of more than 70,000 active members nationwide.

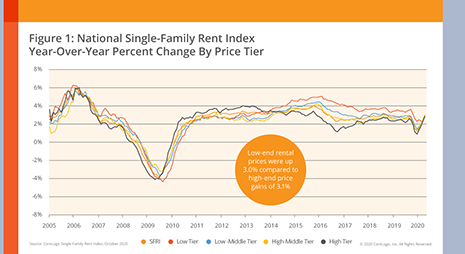

Single-Family Rental Market Stabilizes

CoreLogic, Irvine, Calif., said single-family rent growth increased in October, outpacing their previous-year growth rate for the first time since the pandemic started.

MBA, Trade Groups Urge Treasury to Promote ‘Critical Reforms’ of GSEs

More than 12 years after the federal government placed Fannie Mae and Freddie Mac under conservatorship—and seemingly no closer to moving them out of conservatorship—the Mortgage Bankers Association and several industry trade groups urged the Treasury Department to promote “critical reforms” of the GSEs and bolster their safety and soundness.

MBA: November New Home Purchase Mortgage Applications Fall by 16% Monthly; Up Nearly 35% from Year Ago

The Mortgage Bankers Association’s Builder Application Survey data for November show mortgage applications for new home purchases fell by 16 percent from October but jumped by 34.7 percent from a year ago.

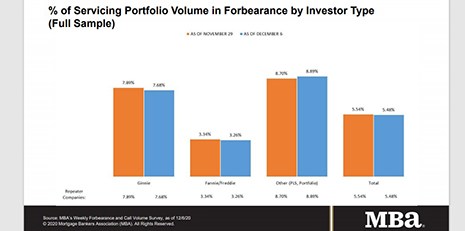

MBA: Share of Mortgage Loans in Forbearance Drops Back to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

With Record-Low Rates, All Signs Move Forward in MBA Weekly Survey

Interest rates fell again last week, and homebuyers took advantage across the board, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending December 11.

MBA Premier Member Profile: LBA Ware

Founded in 2008, LBA Ware™, Macon, Ga., is the leading provider of automated incentive compensation management and business intelligence software for mortgage lenders. Our suite of solutions helps mortgage lenders reach new heights with software that integrates data, incentivizes performance and inspires results.