Genworth: Largest First-Time Homebuyer Purchase Market in 20 Years

Historically low interest rates, change in home preferences, flexible work schedules and increased housing affordability triggered substantial rebound in first-time homebuyer market in the third quarter, said Genworth Mortgage Insurance, Richmond, Va.

The company’s quarterly First-Time Homebuyer Market Report (https://miblog.genworth.com/first-time-homebuyer-market-report) also said private mortgage insurance financed more first-time homebuyers than any other low-down payment mortgage product.

“The third quarter of 2020 was a remarkable quarter for both the housing market and the first-time homebuyer segment, with the most first-time homebuyers purchasing homes in 20 years, and the highest level of home sales since 2006,” said Tian Liu, Chief Economist with Genworth Mortgage Insurance. “Even though the economy is still in the middle of the recession, and a large number of workers remained unemployed or unable to participate in the labor force, there was overwhelming demand for housing and homeownership from those still able to purchase a home.”

Report highlights:

First-time homebuyer activity increased significantly due to low interest rates, greater affordability and re-ignited appreciation of “home:”

o Q3’20: 700,000 single-family homes were purchased by first-time homebuyers, up 15.7% from a year ago

o The number of first-time homebuyers increased by 16.3% from the second quarter to a seasonally-adjusted annual rate of 2.55 million in Q3, the fastest pace on record

o First-time homebuyers represented 39 percent of single-family home sales and 58 percent of all purchase mortgages

• Lower interest rates helped ease housing affordability:

o Mortgage rates for first-time homebuyers decreased from 3.36% in June to 3.01% in September, the lowest interest rate for mortgages on record

o Compared to Q2, lower interest rates reduced mortgage payments by four percent, while higher home prices increased mortgage payments by three percent

First-time homebuyers remain dependent on low-down payment mortgages:

o Overall, 577,000 first-time homebuyers used some form of low-down payment mortgage products to finance their home purchase in Q3, or 82 percent of all first-time homebuyers

o PMI: Low-down payment conventional mortgages, enabled by the PMI industry, helped a record 285,000 first-time homebuyers in Q3, up 34 percent from a year ago

o FHA: The FHA loans program financed 195,000 first-time homebuyers during the quarter, an increase of 8 percent from a year ago

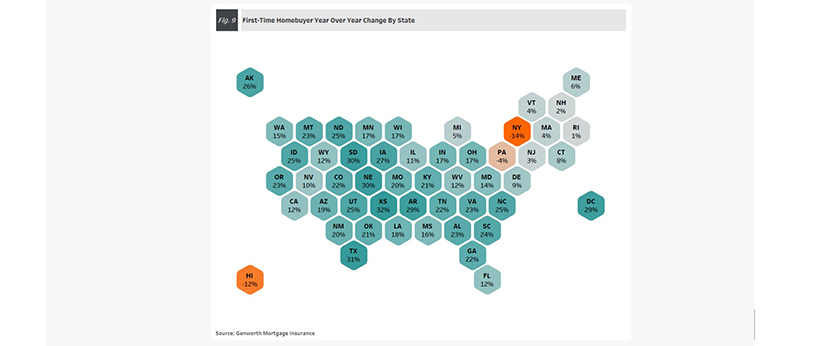

State-by-State COVID-19 Impact:

o An overwhelming number of states reported a higher number of first-time homebuyers in Q3 compared to a year ago

o Only three states– New York, Pennsylvania and Hawaii—reported fewer first-time homebuyers in the quarter compared to a year ago

o For most states, the booming third quarter has erased the sharp declines in the first-time homebuyer market from Q2

o Year-to-date, 47 states and territories reported a higher number of first-time homebuyers

• Repeat buyer market also reported strong growth

o Growth in the third quarter increased by 17 percent from a year ago to 1.08 million units

o In the first 9 months, repeat buyers purchased a total of 2.55 million homes, down one percent compared to the same period last year

o Decrease driven by the sharper slowdown in the repeat buyer market during Q2

Liu said the pandemic has increased preference for homeownership as homes are serving as shelter, office and classroom. “Lower interest rates have made homes more affordable, while reduced spending on personal services, travel and leisure has increased the share of expenditure available for housing,” he said. “A shift in housing preference among existing homeowners is driving repeat buyer activities as they look for different locations and different home features. The housing boom has resulted in higher home prices and sparked an increase in new construction of single-family homes.”

Liu added the housing finance system continued to perform well during the third quarter to ensure access to credit for first-time homebuyers. “The COVID-19 pandemic has stressed the housing finance system in three ways: more hurdles to buy and sell homes; tighter credit availability due to increased credit risk – both actual and perceived; and lack of mortgage industry capacity due to rising demand for refinancing,” he said. “Credit availability for potential first-time homebuyers can be especially vulnerable since first-time homebuyers rely heavily on low-down payment mortgages for financing.”