Lenders tightened mortgage credit in the first half of 2020, as the onset of the COVID-19 pandemic caused the economy to suffer its sharpest single-quarter contraction in history. Mortgage credit availability, as measured by our series of indexes, has recovered slightly in recent months. However, availability is still close to its tightest levels since 2014.

Category: News and Trends

Quote

“The latest housing market data show strong momentum entering 2021, with both

the pace of home sales and new construction booming. We expect that this strong market could benefit

homeowners who need to sell their home, as record-low inventory is causing for-sale homes to go under

contract quickly and is pushing up home prices.”

–MBA Chief Economist Mike Fratantoni.

James Deitch, CMB: The Value of Data and Decision Intelligence in 2021 — and Onward

2020 fostered a new type of innovation for lenders to digitize their loan origination processes or improve workflow management and break down the barriers of the status quo. Sophisticated data management, now more than ever, is a non-negotiable means to maintain an edge over competitors.

Scott Roller: The Ebb and Flow of MSAs in Mortgage

Marketing Services Agreements somewhat remind me of when I’m in a long and slow traffic jam on the interstate, with everyone slowing down to decipher the mystery of what happened and see the first responders doing their thing… unsure of what I might see – tragedy or trivial.

Call for Nominations: MBA NewsLink 2021 Tech All-Star Awards; Deadline Extended to Feb. 5

The Mortgage Bankers Association is accepting nominations for the MBA NewsLink 2020 Tech All-Star Awards. Nominations will be accepted through Friday, Feb. 5

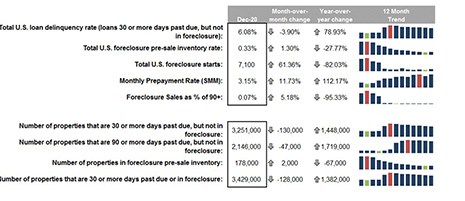

Black Knight First Look: 2020 Ends with Higher Delinquencies, Lower Foreclosures

Black Knight, Jacksonville, Fla., said 2020 ended with 1.54 million more delinquent and 1.7 million more seriously delinquent mortgages than at the start of the year, a looming reminder of the challenges facing the market in 2021.

MBA Advocacy Update, Jan. 25, 2021

On Wednesday, HUD issued a waiver allowing FHA to insure loans to borrowers with residency under the DACA program. And on Tuesday, FHFA issued an RFI on risks posed by climate change and natural disasters to Fannie Mae, Freddie Mac, the Federal Home Loan Banks and the broader housing finance system.

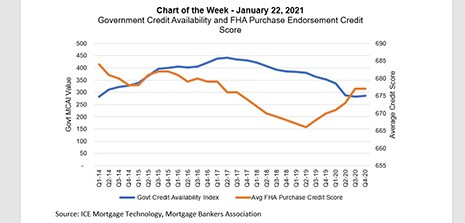

MBA Chart of the Week: Government Credit Availability & FHA Purchase Endorsement Credit Score

Lenders tightened mortgage credit in the first half of 2020, as the onset of the COVID-19 pandemic caused the economy to suffer its sharpest single-quarter contraction in history. Mortgage credit availability, as measured by our series of indexes, has recovered slightly in recent months. However, availability is still close to its tightest levels since 2014.

Existing Home Sales Finish 2020 at Highest Levels Since 2006

Existing home sales finished 2020 with the strongest performance in 14 years, the National Association of Realtors reported on Friday.

Industrial, Apartment Price Growth Bolsters CRE Asset Prices

U.S. commercial property price growth accelerated in late 2020, driven by “robust” apartment and industrial sector price increases, said Real Capital Analytics, New York.