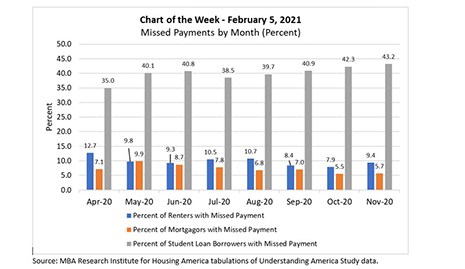

This week’s MBA Chart of the Week chart provides a preview of newly updated pandemic-related household financial insights that MBA’s Research Institute for Housing America released this morning, Feb. 8.

Category: News and Trends

MBA RIHA Study Shows Progress, but 5 Million Renters, Homeowners Missed December Payments

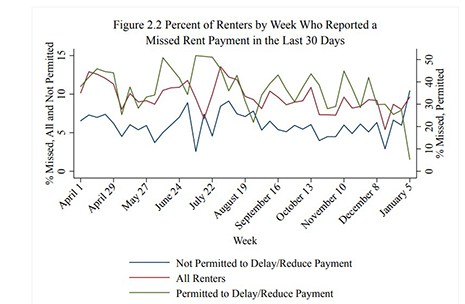

Five million households did not make their rent or mortgage payments in December, and 2.3 million renters and 1.2 million mortgagors believe they are at risk of eviction or foreclosure or would be forced to move in the next 30 days, according to fourth-quarter research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

Troubled Commercial Mortgage Loan Triage: A Special Servicer Roundtable

With the ebb and flow of 2020 market disruption in the rearview mirror and the vaccine rollout in full swing, MBA NewsLink checked in with a special servicer, a rating agency servicer analyst and Freddie Mac asset management chief to explore what is happening in commercial/multifamily markets, where different parts of the commercial real estate finance ecosystem are today and factors driving the outlook for agency and non-agency CMBS sectors.

Quote

“Commercial mortgage loan originations during last year’s fourth quarter were 18% lower than a year earlier, but up significantly from the very low third quarter. Borrowing and lending remain weakest for the property types most impacted by the pandemic – particularly hotel and retail buildings. Multifamily, led by government-backed financing from FHA, Freddie Mac and Fannie Mae, continued to see the strongest commercial mortgage activity.”

–Jamie Woodwell, MBA Vice President of Commercial Real Estate Research.

Adam Batayeh: What Mortgage Lenders Can Learn from Tesla

Historically a cyclical business, mortgage lending has experienced substantial increases in volume, forcing lenders to throttle up their efforts, but those without an intelligent Loan Manufacturing (iLM) plan have been left with more challenges.

James Deitch, CMB: 3 Reasons Executives are Prioritizing Decision Intelligence

We take a closer look at decision intelligence and why mortgage executives are prioritizing this new concept in their business operations.

Savvy Millennials Jump on Low Interest Rates

Average interest rates on 30-year loans fell to historic lows in December, prompting an increase in refinance share from millennial homeowners, according to the latest ICE Mortgage Technology Millennial Tracker.

MBA Advocacy Update Feb. 8 2021

On Tuesday, MBA, along with several trade organizations, submitted a letter to the Office of the Comptroller of the Currency responding to its approach to the Community Reinvestment Act. On Thursday, the House Financial Services Committee held a hearing on the next COVID-19 relief legislation. And the Senate Banking Committee approved Rep. Marcia Fudge’s nomination to be HUD secretary.

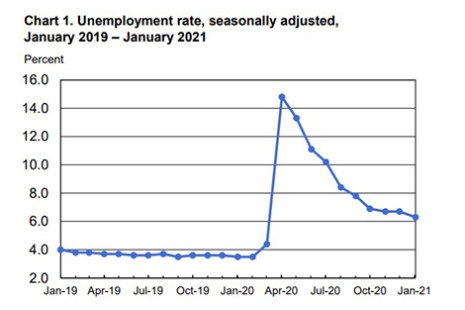

January Employment Picture Brightens a Little

Employers added 49,000 jobs in January, the Bureau of Labor Statistics reported Friday. And while the unemployment rate fell from 6.7% to 6.3%, Americans are still dealing with nearly 10 million jobs fewer than a year ago as a result of the coronavirus pandemic.

mPower: Remaining Resilient Amid Disruption

The pandemic has increased stress on everyone and everything. So MBA CREF21 asked several female business leaders to discuss lessons they have learned while navigating COVID-19 challenges.