Tom Pearce is a co-founder of MAXEX, Atlanta, and serves as its CEO and Chairman of the Board. He brings more than 30 years of expertise within the community banking and insurance arenas as well as expertise within the mortgage finance, credit and asset management arenas.

Category: News and Trends

Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

Anita Bush: Effective Forbearance Management for Mortgage Loan Servicers

In this article, we’ll address some of the servicer’s legal requirements and offer three keys to success intended to help servicers manage the post-forbearance process.

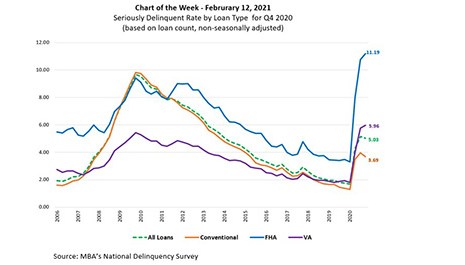

MBA Chart of the Week: NDS Seriously Delinquent Rate By Loan Type

MBA last week released its National Delinquency Survey results for the fourth quarter. The delinquency rate for mortgage loans on one-to-four-unit residential properties at the end of the quarter decreased from a seasonally adjusted rate of 7.65 percent of all loans outstanding in the third quarter to 6.73 percent in the fourth quarter. This 92-basis-point drop in the delinquency rate was the biggest quarterly decline in the history of MBA’s survey dating back to 1979.

Quote

“MBA welcomes today’s announcement from HUD and the Biden Administration extending COVID-19-related homeowner relief, as well as foreclosure and eviction moratoriums, and believes it provides necessary assistance for homeowners and important guidance for mortgage servicers. We will continue to work with the administration, Congress and other stakeholders on aligning policies and initiatives that will help consumers during the pandemic.”

–MBA President & CEO Robert Broeksmit, CMB.

MBA Launches Licensing Flexibility Campaign with State Partners

The Mortgage Bankers Association recently launched a new campaign with its state and local association partners aimed at updating state law and rules to provide mortgage loan originators and their state licensed employers greater flexibility for remote location work arrangements during—and especially beyond—the coronavirus pandemic.

Non-QM on the Upswing: A Conversation with Dane Smith, President of Verus Mortgage Capital

MBA NewsLink talked with Dane Smith, President of Verus Mortgage Capital, Washington D.C., about why the firm has chosen to work with correspondent lenders to build its portfolio of Non-Qualified Mortgage assets.

MBA Advocacy Update Feb. 16 2021

On Thursday, the House Financial Services Committee passed legislation along party lines that includes key housing provisions of President Biden’s $1.9 trillion American Rescue Plan. On Tuesday, the Federal Housing Finance Agency extended its foreclosure and eviction moratorium for Enterprise-backed, single-family mortgages and REO properties through March 31. FHFA also announced it would extend GSE origination flexibilities through March 31.

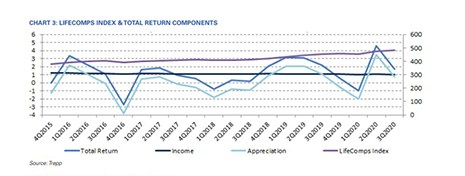

Life Insurance Commercial Mortgage Return Index Stabilizes

Trepp, New York, said commercial mortgage investments held by life insurance companies remained positive in late 2020 for the third consecutive quarter.

Industry Briefs Feb. 16 2021

LodeStar Software Solutions announced an integration with Mortgage Coach, creator of the Total Cost Analysis Borrower Conversion Platform. This integration allows lenders of any size to include accurate closing provider fees when creating a Total Cost Analysis for borrowers.