Construction lending calls for a high degree of perseverance and accuracy to mitigate its inherent risks. The COVID-19 pandemic has made business much more difficult and complex.

Category: News and Trends

Rana Fleming of Genworth Mortgage Insurance on Critical Role Homeowner Assistance Programs Play During a Pandemic

Rana Fleming is Director of Homeowner Assistance and Servicer Reporting with Genworth Mortgage Insurance, Raleigh, N.C. She joined Genworth in 2012.

MBA Advocacy Update–Mar. 15, 2021

On Thursday, President Biden signed a $1.9 trillion COVID-19 stimulus bill with provisions to provide additional direct assistance to renters, homeowners, and businesses affected by the pandemic. On Wednesday, the Senate confirmed Marcia Fudge on a bipartisan basis to be the first woman to lead HUD in more than 40 years (and the second Black woman confirmed as Secretary).

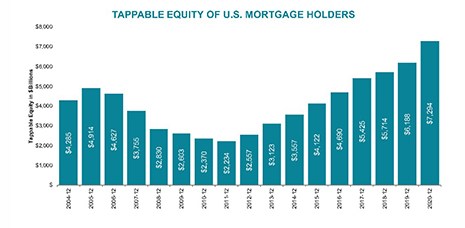

Black Knight: Tappable Equity Skyrockets to Record High

A rising tide lifts all boats, the saying goes. And for the nation’s homeowners, home price growth—buoyed by scant housing inventories and historically low interest rates—created unprecedented tappable equity in 2020, said Black Knight, Jacksonville, Fla.

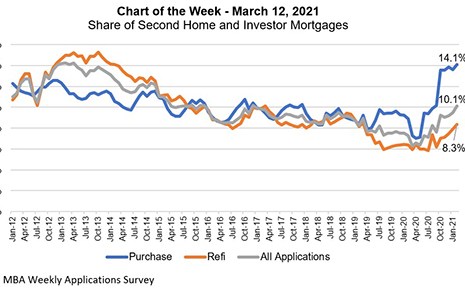

MBA Chart of the Week, Mar. 15, 2021: Share of Second Home & Investor Mortgages

This week’s MBA Chart of the Week captures the share of mortgage applications to purchase or refinance a second home or investment property.

Apartment Rents Jump at Fastest Rate in 2 Years

Apartment effective asking rents climbed 0.6 percent in February, the fastest single-month pace seen since the middle of 2019, reported RealPage, Richardson, Texas.

Dealmaker: Enterprise Housing Credit Investments Closes $29M in Tax Credit Investments

Enterprise Housing Credit Investments, Columbia, Md., announced $29 million in tax credit investments in two multifamily properties

The Week Ahead—Mar. 15, 2021

Good morning! Another busy week is shaping up in Washington—on Capitol Hill and at the Mortgage Bankers Association.

Distressed Debt Monitor: CBRE’s Patrick Connell on the Role of Receiverships

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.

(Switching Gears) Nate Johnson: Will You Be Able to Transition Staff When the Market Shifts?

Are we looking at a downturn? Yes, but in my view, it’s not going to be significant enough to see a huge migration of people out of the mortgage industry. It will, however, require every organization to think hard about how to best use their personnel resources to come out ahead.