Today’s customers live online and expect relevant, personalized content and messaging that resonates with their individual wants and needs. That leaves plenty of opportunity for lenders to connect with this massive cohort by providing value and education.

Category: News and Trends

Lori Brewer: Lender Staffing Data Signals Need to Automate Back Office and Monitor Performance

Lenders hiring their way through spikes in volume, as they have for decades, is a suboptimal, efficiency-draining reaction — not a strategic business decision. Any time lenders hire to manage temporary spikes in volume they reduce profitability, add enterprise risk and pour valuable internal resources into a hiring-firing routine that can destabilize and discourage an entire organization long after volume has normalized.

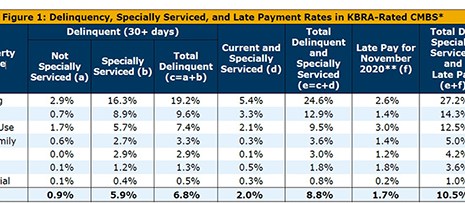

KBRA: Review Those Remittance Reports

Kroll Bond Rating Agency, New York, said higher commercial mortgage-backed securities special servicing volume and modifications increase the risk of operational errors or inconsistencies in servicer and trustee reporting.

CMBS Article Headline HERE

CMBS Article lede sentence HERE

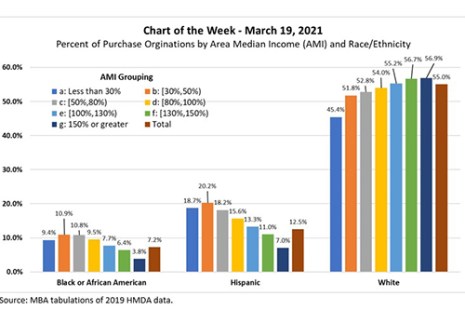

MBA Chart of the Week: Percent of Originations by Median Income, Race/Ethnicity

We analyzed the 2019 Home Mortgage Disclosure Act data for the 30 largest metropolitan statistical areas to understand the distributions of first lien mortgage purchase originations by Area Median Income and by race/ethnicity.

Dealmaker: JLL Secures $393M to Redevelop 125 West End Ave. in Manhattan

JLL Capital Markets, Chicago, arranged a $393 million construction financing to redevelop 125 West End Ave. in Manhattan into a life sciences facility.

MBA Advocacy Update Mar. 22, 2021

On Monday, HUD finalized updated forms in the FHA Single-Family Condo approval process. On Tuesday, the Senate Banking, Housing, and Urban Affairs Committee held the first of what is expected to be a series of oversight hearings on housing policy this year. And on Thursday, MBA submitted feedback to FHA in response to ML 2021-05, which extends the foreclosure and eviction moratorium and expands the use of FHA’s COVID-19 Loss Mitigation options.

The Week Ahead—Mar. 15, 2021

Capitol Hill is busy again this week. On Tuesday, Mar. 23, Treasury Secretary Janet Yellen and Federal Reserve Chairman Jerome Powell visit (virtually) the House Financial Services Committee for a hearing on “Oversight of the Treasury Department’s and Federal Reserve’s Pandemic Response.

(Switching Gears) William Tessar: Investor Loans–Where the Smart Originator Will Be When Rates Go Up

With the benchmark 30-year fixed rate beginning to creep higher, however, we may start to face a new reality. That’s why smart originators are already thinking about how to generate business when the refi dust settles. And many are setting their sights on the real estate investor channel, because the opportunities for business growth are incredible.

Industry Briefs Mar. 22, 2021

Fairway Independent Mortgage Corp., Madison, Wis., in the wake of recent actions by United Wholesale Mortgage to obtain exclusive partnerships with mortgage brokers, said it reaffirmed its commitment to all its mortgage origination partners, including mortgage brokers help consumers find options for financing a home.