In the initial article of this series, we addressed the value of setting behavioral requirements for LOs who are not reaching their goals to produce their agreed-upon numbers. The second article offered a process for setting standards so underperforming LOs know what’s expected of them. You’re about to read a presentation of how to respond when they strive to meet those behavioral standards.

Category: News and Trends

MBA Weekly Applications Survey May 5, 2021: Activity Down 2nd Straight Week

Mortgage applications fell overall from one week earlier as interest rates inched up, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending April 30.

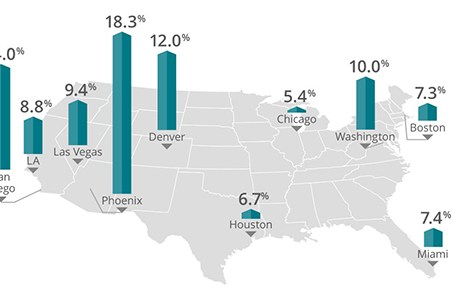

CoreLogic: Millennial Demand Pushes Home Prices to Highest Annual Growth in 15 Years

CoreLogic, Irvine, Calif., reported its monthly Home Price index recorded an 11.3% annual gain in March, the highest rate since March 2006.

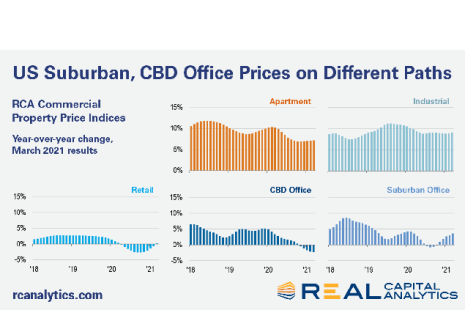

CRE Price Trends Diverge Across Property Types

CoStar, Washington, D.C., reported commercial real estate asset prices diverged by property type during the first quarter.

CFPB Reports Detail Mortgage Borrowers’ Continuing COVID-19 Challenges

The Consumer Financial Protection Bureau released two reports, saying more work needs to be done to help mortgage borrowers coping with the COVID-19 pandemic and economic downturn.

CMBS Market Musings: Trophy Asset and Transitional Loan Transactions Thrive

The private-label CMBS market remains a mixed bag showing signs of a K-shaped recovery in the second quarter with delinquency and default numbers trending down now for nine consecutive months.

Dealmaker: Berkadia Closes $90M in Multifamily Transactions

Berkadia closed two multifamily transactions totaling $90.4 million in Virginia and Massachusetts.

Joe Murin: Does Limited Housing Inventory Mean the Beginning of the End of Housing Boom…or End of the Beginning?

Soaring home prices and raging demand will not be enough to slow the housing train. In fact, they may actually help it.

Quote

“Both conventional and government purchase applications declined, but average loan sizes increased for each loan type. This is a sign that the competitive purchase market, driven by low housing inventory and high demand, is pushing prices higher and weighing down on activity. The higher prices are also affecting the mix of activity, with stronger growth in purchase loans with larger-than-average balances.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

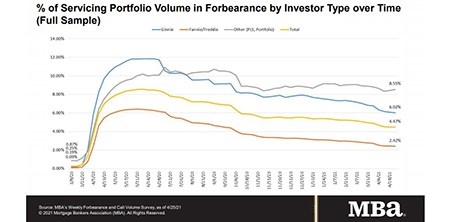

Share of Mortgage Loans in Forbearance Down 9th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 4.47% of servicers’ portfolio volume as of April 25 from 4.49% in the prior week, the ninth straight weekly decrease. MBA estimates 2.23 million homeowners are in forbearance plans.