To extend Remote Online Notarization legislation nationwide, lenders are going to have to get their “back up off the wall” and join MBA efforts to press rulemakers for laws that enable homebuyers and the real estate finance industry to benefit from modern business practices that so many other industries already enjoy.

Category: News and Trends

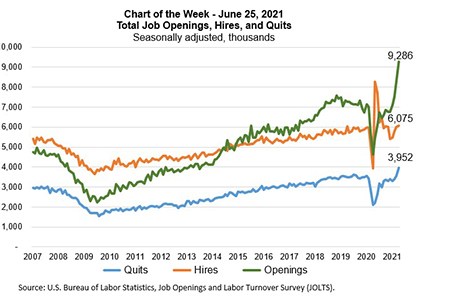

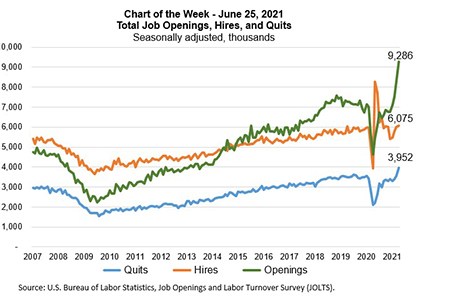

MBA Chart of the Week June 28 2021: Total Job Openings, Hires and Quits

In this week’s MBA Chart of the Week, we examine the monthly data series on job openings, hires and separations produced by the U.S. Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) program.

People in the News June 29, 2021

The White House appointed Sandra L. Thompson as Acting Director of the Federal Housing Finance Agency effective immediately.

Call for Speakers: MBA Risk Management, QA & Fraud Prevention Forum–Deadline TODAY

Full session and individual speaker proposals are now being accepted for the Mortgage Bankers Association’s Risk Management, QA and Fraud Prevention Forum 2021, taking place Sept. 28–29 via MBA LIVE.

MBA Advocacy Update June 28 2021

On Wednesday, President Biden replaced FHFA Director Mark Calabria with Sandra L. Thompson, naming her Acting Director effective immediately. On Thursday, President Biden announced his intention to nominate Julia Gordon as the next FHA Commissioner.

HUD Proposes Restoring ‘Disparate Impact’ Rule

HUD on Friday proposed to restore its 2013 Discriminatory Effects Standard—known in the industry as the “Disparate Impact” rule.

‘New Cracks’ in Affordable Housing Foundation

Fitch Ratings, New York, said the coronavirus pandemic “created new cracks” in the already fragile foundation of affordable housing.

Matt Hansen: Get Your Back Up Off the Wall: Support MBA RON Advocacy Efforts

To extend Remote Online Notarization legislation nationwide, lenders are going to have to get their “back up off the wall” and join MBA efforts to press rulemakers for laws that enable homebuyers and the real estate finance industry to benefit from modern business practices that so many other industries already enjoy.

MBA Chart of the Week June 28 2021: Total Job Openings, Hires and Quits

In this week’s MBA Chart of the Week, we examine the monthly data series on job openings, hires and separations produced by the U.S. Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) program.

The Week Ahead—June 28, 2021

Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open—and MBA makes a big splash today with announcement of two keynote speakers: New York Times best-selling author Malcolm Gladwell and Academy Award- and Presidential Medal of Freedom Award-winning actress Rita Moreno.