MBA Chart of the Week June 28 2021: Total Job Openings, Hires and Quits

Even with the recent burst in economic activity and hiring, as nearly two-thirds of the U.S. adults have received at least one COVID vaccination, the unemployment rate and overall payroll levels have not returned to pre-pandemic levels of job market health.

While job openings have soared as businesses reopen, many employers are running into difficulty re-hiring and filling open positions, leading many commentators to speak of a “mismatch” between strong labor demand and more constrained labor supply. Indeed, the labor force participation rate in May, at 61.6 percent, remained 1.7 percent lower than in February 2020.

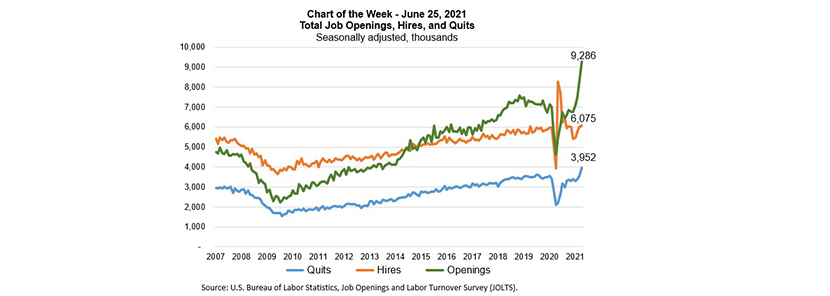

In this week’s MBA Chart of the Week, we examine the monthly data series on job openings, hires and separations produced by the U.S. Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS) program.

The orange line shows total job hires have been increasing month-over-month since December 2020, and in March and April of this year (at 6.01 million and 6.08 million, respectively) they exceeded pre-pandemic levels. However, openings (green line) have surpassed hires since summer 2020, and the sharp increase to 9.29 million openings in April is 1.7 million greater than the series’ previous high point (shown on the chart) of 7.57 million at the end of 2018. It is also more than two million higher than the pre-pandemic level in February 2020.

Additionally, the number of workers quitting their jobs voluntarily (blue line) is also above pre-pandemic levels. High quit rates, often viewed as a measure of job market confidence, may indicate better job prospects for workers as we return to a “more normal” post-pandemic economy.

We also continue to closely monitor weekly U.S. Department of Labor initial and continuing unemployment claims data. Initial claims remain elevated at above 400,000 (versus quarter of a million pre-pandemic), and as some states start to end supplementary unemployment programs, we will track how this may affect the evolution of labor markets. This ongoing improvement in employment situation provides households with firmer financial footing, supports growth in the home purchase market, reduces mortgage delinquencies and helps steadily decreasing mortgage forbearance rates.

–Joel Kan (jkan@mba.org), Edward Seiler (eseiler@mba.org)