Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as New York Times best-selling authors Malcolm Gladwell and Brad Meltzer keynote General Sessions on Tuesday, Oct. 19.

Category: News and Trends

MBA Advocacy Update July 6 2021

The CFPB released its final rule amending select requirements of Regulation X to assist borrowers impacted by COVID-19. Also last week, MBA President and CEO Bob Broeksmit, CMB, sent a letter to the leaders of the National Governors Association and CSBS to ask for their assistance in addressing the challenges MBA member companies face as they attempt to reopen their offices.

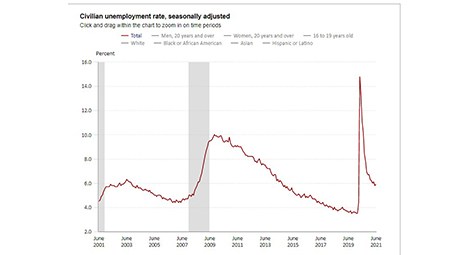

June Jobs Report Blows Past Expectations

Total nonfarm employment increased by 850,000 in June, the Bureau of Labor Statistics reported Friday, well above expectations amid rising demand for services hit hard by the coronavirus pandemic.

MBA Urges Federal Agencies to Clarify How AI Technologies Apply to Regs

The Mortgage Bankers Association last week asked federal regulatory agencies to clarify how existing fair lending and the Equal Credit Opportunity Act adverse action notification requirements apply to Artificial Intelligence technologies.

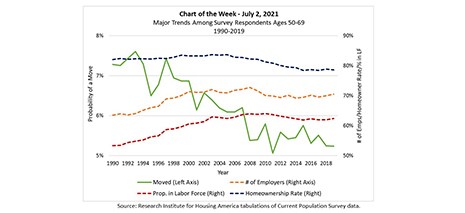

MBA Chart of the Week July 6 2021: Older Workers’ Labor Force Participation

The Research Institute for Housing America, MBA’s think tank, released a special report that examines why, since the 1990s, older workers’ labor force participation has increased while their migration has decreased, counter to conventional economic wisdom.

MBA CONVERGENCE Partner Profile: Laird Nossuli, iEmergent

Laird Nossuli is CEO of iEmergent, Urbandale, Iowa, an analytics and advisory firm that helps lenders leverage data and diversity to develop sustainable lending strategies. Her educational background in community development and her passion for housing equity fuel her participation as a Steering Committee member in CONVERGENCE Columbus and led to iEmergent’s role as a national partner.

Dealmaker: Greystone Arranges $115M in Multifamily, Affordable Housing

Greystone, New York, arranged $115.2 million in construction financing for a multifamily development in New Jersey and affordable housing developments in Michigan.

Industry Briefs July 6, 2021

The Federal Housing Finance Agency issued a Policy Statement on Fair Lending. The Policy Statement communicates FHFA’s commitment to comprehensive fair lending oversight of Fannie Mae, Freddie Mac and the Federal Home Loan Banks and provides a foundation for building out FHFA’s fair lending program.

People in the News July 6, 2021

The Mortgage Bankers Association announced Teressa Lurk, Vice President of Marketing and Design, was recognized by HousingWire as a recipient of the publication’s inaugural 2021 Marketing Leader award, which recognizes creative and influential marketing minds in the housing industry.

The Week Ahead—July 6, 2021

Because of the holiday weekend, the Mortgage Bankers Association’s weekly Forbearance & Call Volume Survey, which usually comes out on Mondays, will be released this afternoon at 4:00 p.m. ET.