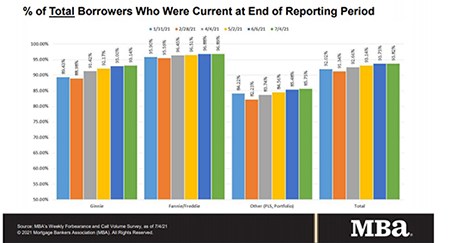

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 11 basis points to 3.76% of servicers’ portfolio volume as of July 4 from 3.87% the week before,–the 19th consecutive weekly decline. MBA estimates 1.9 million homeowners are in forbearance plans.

Category: News and Trends

Dealmaker: Bellwether Enterprise Closes $20M for Affordable Housing

Bellwether Enterprise Real Estate Capital LLC, Cleveland, closed $19.5 million in loans for affordable housing assets in North Carolina and Minnesota.

Millennial Homeownership Increases as Credit Loosens

ICE Mortgage Technology, Pleasanton, Calif., said the number of purchase loans closed by millennials in May jumped to 67%; for younger millennials, the percentage was even higher (82%).

Industry Briefs July 13, 2021

FormFree, Athens, Ga., partnered with ICE Mortgage Technology, part of Intercontinental Exchange Inc., a provider of data, technology and market infrastructure, to make its AccountChek 3n1 asset, income and employment verification service available in the Encompass cloud-based loan origination platform

Louis Zitting: Are You Giving Your Old Contacts a Fresh Look?

The reality is that most loan officers with a good-sized database have plenty of contacts who are ready to finance or refinance right now—they just don’t know who they are. But there are ways to identify them and turn a missed opportunity into a success story.

Quote

“Forbearance exits increased in the week of the July 4 holiday to the fastest pace since early April. New requests stayed very low, resulting in a large drop in the share of loans in forbearance, particularly for Ginnie Mae loans, which also continue to be impacted by buyouts of delinquent loans. These loans are tracked as portfolio loans after a buyout.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

MBA Advocacy Update July 12, 2021

MBA submitted recommendations to FHFA last week with respect to the GSEs’ policies addressing eligibility of condominium projects that include short-term rentals. Also last week, Ginnie Mae announced it will continue current measures that allow for the electronic execution and transmission of form HUD 11711A (Release of Security Interest) and form HUD 11711B (Certification and Agreement).

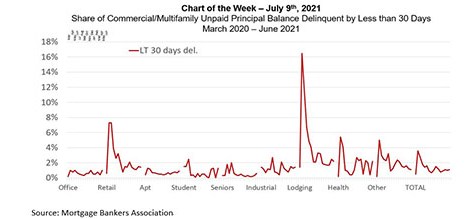

MBA Chart of the Week, July 9, 2021: Commercial/Multifamily Delinquencies

When looking at commercial and multifamily mortgage delinquency rates, we tend to exclude loans that have been delinquent for less than 30 days, as many may be experiencing a temporary “hiccup” that will be quickly remedied before the next payment is due. But examining these rates can provide key insights into commercial and multifamily mortgage performance through the pandemic and into today.

Sponsored Content from SWBC: Improve the LPI Borrower Experience by Leveraging Innovative Technology

In this article, we’ll discuss how EDI and RPA technologies help lenders streamline insurance tracking and verification and reduce direct member contact.

People in the News July 13, 2021

Wipro Opus Risk Solutions LLC, tapped Greer Allgood as managing director of mortgage operations. She is responsible for overall management of specific client and deal transactions.