MBA, Trade Groups Oppose Amendment Altering False Claims Act

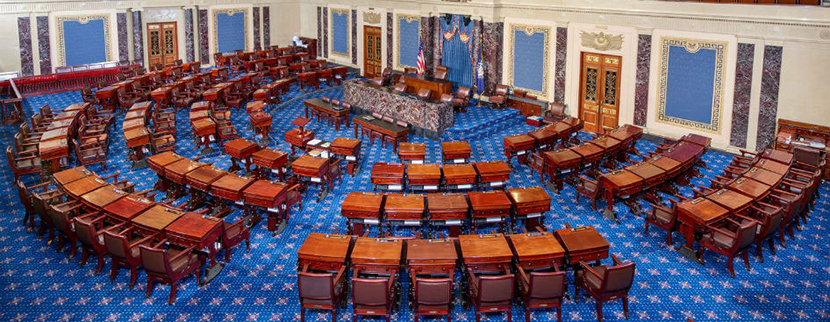

As the Senate plods toward what appears to be eventual passage of a massive infrastructure framework, the Mortgage Bankers Association and several other industry trade groups expressed opposition to an amendment that would unfavorably alter the False Claims Act.

The Grassley/Leahy Amendment, introduced by Sens. Charles Grassley, R-Iowa, and Patrick Leahy, D-Vt., would amend H.R. 3684, the legislative vehicle for the bipartisan infrastructure framework. The Amendment would make changes to the False Claims Act making it easier for consumer to file small claims and provide incentives to encourage whistleblowers to come forward.

However, MBA, the American Bankers Association and the Housing Policy Council warned legislators that the Grassley/Leahy Amendment, in its current form, would have unintended consequences, including harm to the housing market and barriers for the housing market to work with the private sector to distribute COVID-related rental and homeowner assistance.”

“We recognize the importance of the FCA in protecting taxpayers from fraud, waste and abuse at a time when the federal government is seeking to distribute trillions of dollars in much-needed COVID-related economic aid,” said the letter to Senate leadership. “However, the Amendment would make both substantive and retroactive changes to the FCA without benefit of congressional hearings, testimony or more rigorous legal analysis to determine its impact and likely unintended consequences.”

“MBA will continue to oppose any attempts at legislative or regulatory change pertaining to the FCA that reduces access to credit and leads to higher costs of FHA financing for first-time, low- to moderate-income and minority homebuyers,” said Bill Killmer, MBA Senior Vice President for Legislative and Political Affairs.

The letter said the potential for unintended consequences from the Amendment is not hypothetical. “The housing finance industry incurred billions of dollars of false claims liability over the last decade because the Federal Housing Administration and Department of Justice over-pursued lenders for minor errors on defaulted FHA insured loans that had no causal relationship to the reason for default,” the letter said. “That experience forced many lenders to exit the FHA program, while other lenders responded to that risk by imposing sharply higher qualifying requirements on FHA borrowers.”

The result, the letter pointed out, “was a decade of reduced access and higher costs of FHA financing for first-time, low- to moderate-income, and minority homebuyers that the program is designed to serve. Only recently have changes to the FHA program certifications provided lenders with greater certainty and reduced the risk of draconian penalties they could be exposed to for immaterial data or documentation errors.”

The letter warned just as those changes have begun to attract lenders back to the program and reduce the credit tightening that limited access to FHA-insured loans, the proposed Amendment, if enacted, would threaten to reverse that progress.

“The proposed Amendment’s impact could further slow desperately needed aid to COVID-impacted families and introduce new FCA litigation uncertainty into the mortgage market,” the letter warned. “To avoid such unintended consequences, we urge more careful consideration of the substantive legal changes contained within Amendment 2435. We strongly urge that Amendment 2435 not be considered as part of the current debate regarding the bipartisan infrastructure package.”